| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3923900080 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3926904590 | Doc | 58.5% | CN | US | 2025-05-12 |

| 8424909080 | Doc | 105.0% | CN | US | 2025-05-12 |

| 3923290000 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3915900090 | Doc | 55.0% | CN | US | 2025-05-12 |

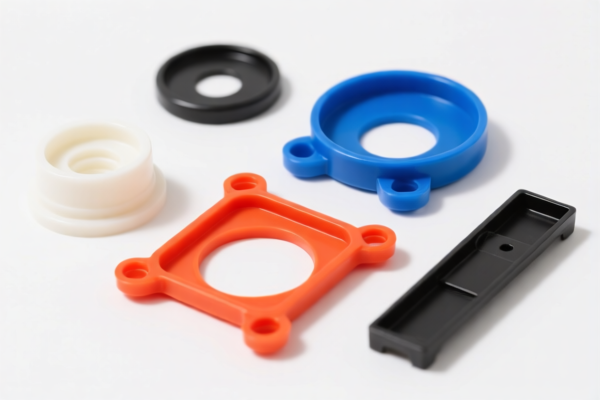

Here is the structured classification and tariff information for the plastic parts you've declared, based on the provided HS codes:

✅ HS CODE: 3923109000

Product Description: Plastic parts boxes, plastic tool part boxes, and other similar plastic containers or boxes.

Total Tax Rate: 58.0%

Tariff Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to general-purpose plastic boxes or containers used for storage or organization.

- Action Required: Confirm the exact use and material composition of the product to ensure correct classification.

✅ HS CODE: 8424909080

Product Description: Plastic parts used as components of spray equipment.

Total Tax Rate: 105.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Steel/Aluminum Products Additional Tariff: 50.0% (not applicable here, but note for similar products)

Key Notes:

- This code is for spray equipment parts, which may be subject to higher tariffs due to its classification under machinery.

- Action Required: Verify if the product is indeed a component of spray equipment and not a general-purpose part.

✅ HS CODE: 3923900080

Product Description: Plastic connectors, plastic labels, and other plastic transport or packaging items.

Total Tax Rate: 58.0%

Tariff Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code covers transport or packaging-related plastic parts, such as connectors or labels.

- Action Required: Ensure the product is not classified under a more specific code (e.g., 3923109000).

✅ HS CODE: 3926904590

Product Description: Plastic seals, gaskets, or other sealing components.

Total Tax Rate: 58.5%

Tariff Breakdown:

- Base Tariff: 3.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for sealing parts, which are often used in industrial or mechanical applications.

- Action Required: Confirm the exact function and material of the seal to avoid misclassification.

✅ HS CODE: 3915900090

Product Description: Plastic waste or scrap, not otherwise specified.

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to plastic waste or scrap, which may be subject to environmental regulations.

- Action Required: Confirm if the product is indeed waste or scrap and not a reusable part.

📌 Proactive Advice for All Products:

- Verify Material: Ensure the product is made of plastic and not a composite or mixed material.

- Check Unit Price: High-value items may be subject to additional scrutiny or duties.

- Certifications: Some products may require customs declarations, origin certificates, or environmental compliance documents.

- Tariff Changes: Be aware that additional tariffs will increase after April 11, 2025, so plan accordingly for cost implications.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.