| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8544110020 | Doc | 58.5% | CN | US | 2025-05-12 |

| 7403120000 | Doc | 56.0% | CN | US | 2025-05-12 |

| 7408210000 | Doc | 58.0% | CN | US | 2025-05-12 |

| 8544604000 | Doc | 58.5% | CN | US | 2025-05-12 |

| 8544492000 | Doc | 58.5% | CN | US | 2025-05-12 |

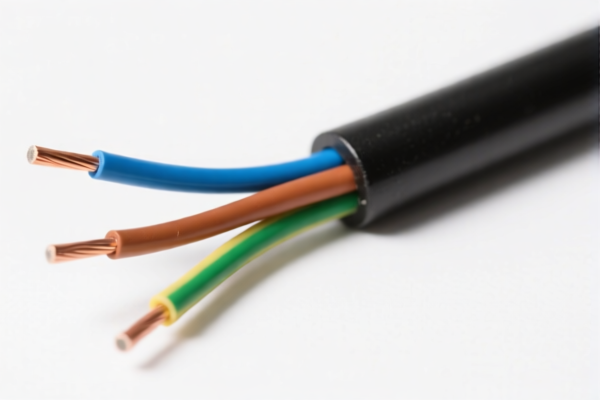

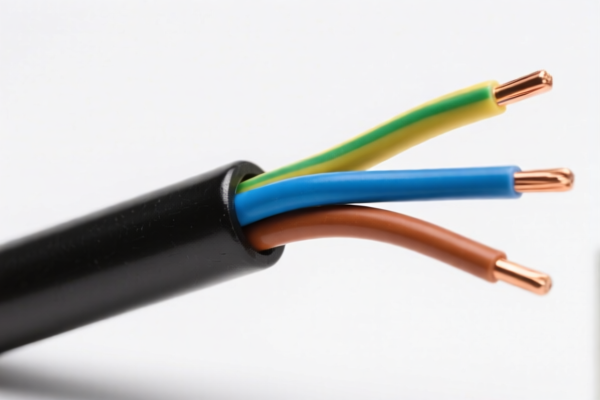

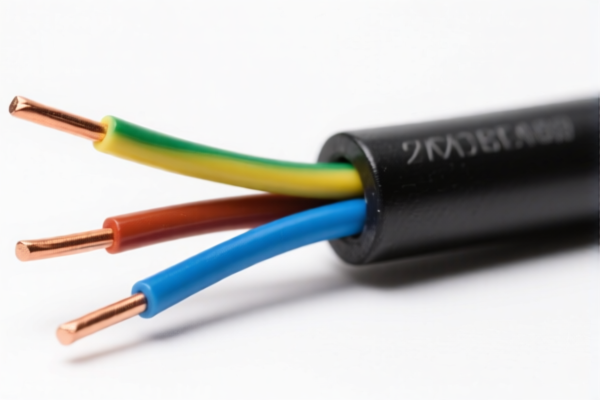

Based on the product declaration "insulated copper wire", the following HS codes and tariff information are relevant for customs compliance and classification:

✅ HS CODE: 8544110020

Product Description:

Insulated (including enameled or anodized) wires, cables, or other insulated conductors, whether or not fitted with connectors; optical fiber cables composed of individual sheathed fibers, whether or not assembled with conductors or fitted with connectors.

Tariff Information:

- Base Tariff Rate: 3.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.5%

Key Notes: - This code is most likely the correct classification for insulated copper wire with general insulation (e.g., enamel, plastic, etc.). - If the wire is not fiber optic and is not assembled with connectors, this code still applies. - Time-sensitive alert: Additional tariffs will increase to 30.0% after April 11, 2025.

✅ HS CODE: 8544604000

Product Description:

Insulated wires, cables (including copper core insulated wires).

Tariff Information:

- Base Tariff Rate: 3.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.5%

Key Notes: - This code is also applicable for insulated copper wire, especially if it is not enameled or anodized. - It is a more general category than 8544110020. - Time-sensitive alert: Additional tariffs will increase to 30.0% after April 11, 2025.

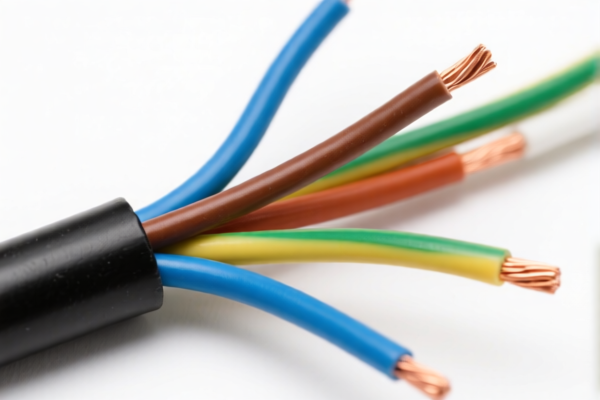

✅ HS CODE: 8544492000

Product Description:

Insulated (including enameled or anodized) wires, cables (including copper stranded insulated wires) and other insulated conductors, whether or not fitted with connectors; optical fiber cables composed of individual sheathed fibers, whether or not assembled with conductors or fitted with connectors.

Tariff Information:

- Base Tariff Rate: 3.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.5%

Key Notes: - This code is broader and includes stranded copper insulated wires. - It may be used if the wire is stranded or not enameled. - Time-sensitive alert: Additional tariffs will increase to 30.0% after April 11, 2025.

❗ Other Codes (for reference):

HS CODE: 7403120000

Product Description:

Refined copper (not in Chapter 7405) in the form of rods or wire.

Tariff Information:

- Base Tariff Rate: 1.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 56.0%

Key Notes: - This code applies to uninsulated copper wire (e.g., raw copper wire). - Not applicable if the wire is insulated. - Time-sensitive alert: Additional tariffs will increase to 30.0% after April 11, 2025.

HS CODE: 7408210000

Product Description:

Insulated brass wire.

Tariff Information:

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.0%

Key Notes: - This code applies to brass insulated wire, not copper. - Not applicable if the wire is made of copper. - Time-sensitive alert: Additional tariffs will increase to 30.0% after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify the material: Ensure the wire is made of copper, not brass or other alloys.

- Check insulation type: If the wire is enameled, anodized, or plastic-insulated, use HS CODE 8544110020 or 8544492000.

- Check if it is stranded: If it is stranded copper, use HS CODE 8544492000.

- Check for connectors: If the wire is fitted with connectors, this may affect classification.

- Check for certifications: Some products may require CE, RoHS, or other certifications depending on the end-use.

- Monitor tariff changes: Be aware that additional tariffs will increase to 30.0% after April 11, 2025.

Let me know if you need help determining the most accurate HS code based on your product specifications.

Customer Reviews

No reviews yet.