| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8504409570 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8504409540 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8501809000 | Doc | 57.4% | CN | US | 2025-05-12 |

| 8511500000 | Doc | 57.5% | CN | US | 2025-05-12 |

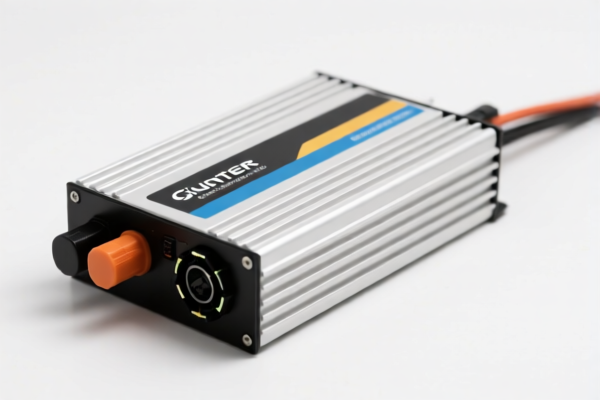

Here is the structured classification and tariff information for your declared product "inverter" based on the provided HS codes and tax details:

✅ Product Classification Overview: Inverter

1. General Classification: 8504409570

- Description: Covers a wide range of inverters including industrial, photovoltaic (solar), high-frequency, high-efficiency, and storage inverters.

- HS CODE: 8504409570

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code also applies to inverter filters as accessories.

2. Special Case: Micro Inverter (8501809000)

- Description: Specifically for micro inverters used in solar systems.

- HS CODE: 8501809000

- Total Tax Rate: 57.4%

- Tariff Breakdown:

- Base Tariff: 2.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is not applicable to standard inverters or inverter filters.

3. Special Case: Inverter Generator (8511500000)

- Description: Applies to inverter generators (portable power units).

- HS CODE: 8511500000

- Total Tax Rate: 57.5%

- Tariff Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is not applicable to standard inverters or inverter filters.

4. Special Case: Inverter Power Supply (8504409540)

- Description: Applies to inverter power supplies.

- HS CODE: 8504409540

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is not applicable to standard inverters or inverter filters.

⚠️ Important Notes and Recommendations

-

Time-Sensitive Policy:

Additional tariffs of 30.0% will be imposed after April 11, 2025. Ensure your import timeline is planned accordingly. -

Certifications Required:

Verify if your product requires any certifications (e.g., CE, RoHS, or specific import permits) depending on the destination country. -

Material and Unit Price:

Verify the exact product specification and unit price to ensure correct classification and avoid misdeclaration. -

Clarify Product Type:

If your product is a micro inverter, inverter generator, or inverter power supply, it may fall under a different HS code with a higher tax rate.

✅ Proactive Action Steps

- Confirm the exact product type (e.g., standard inverter, micro inverter, inverter generator, or inverter power supply).

- Check if your product is subject to anti-dumping duties (if applicable, though not listed here).

- Ensure accurate HS code classification to avoid delays or penalties during customs clearance.

Let me know if you need help determining the exact HS code based on your product specs.

Customer Reviews

I couldn’t have exported my plastic doors without this info. The HS code and tariff details were spot-on and easy to understand.

The HS code section was very helpful, but I found the tariff information a bit hard to navigate. Still, it was worth the time.

Clear and concise information on the 5% tariff rate for plastic doors. Perfect for someone new to international trade.

The site provided useful trade details for plastic products. I wish there were more examples, but it's still helpful.

I was impressed by the detailed explanation of the HS code for plastic doors. Made exporting to the US much more straightforward.