| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8504409570 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8501809000 | Doc | 57.4% | CN | US | 2025-05-12 |

| 8511500000 | Doc | 57.5% | CN | US | 2025-05-12 |

| 8504409540 | Doc | 55.0% | CN | US | 2025-05-12 |

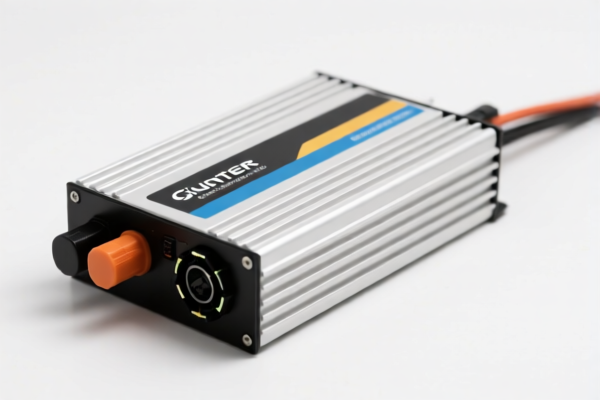

Here is the classification and tariff information for the declared product "inverters" based on the provided HS codes:

✅ HS CODE: 8504409570

Product Description:

- Inverters, variable frequency inverters, industrial inverters, photovoltaic inverters, high-frequency inverters, high-efficiency inverters, energy storage inverters, single-phase inverters, portable inverters, etc.

Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This code is the most commonly used for general-purpose inverters. - Be aware of the April 11, 2025 tariff increase from 25% to 30%. - Ensure the product is not classified under a more specific code (e.g., 8501809000 for micro-inverters).

✅ HS CODE: 8501809000

Product Description:

- Micro-inverters (small-scale, often used in solar panel systems)

Tariff Information:

- Base Tariff Rate: 2.4%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.4%

Key Notes: - This code applies specifically to micro-inverters. - The base tariff is slightly higher than 8504409570. - The April 11, 2025 increase also applies here.

✅ HS CODE: 8511500000

Product Description:

- Inverter generators (combined inverter and generator units)

Tariff Information:

- Base Tariff Rate: 2.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.5%

Key Notes: - This code is for inverter generators, which are hybrid devices. - The base tariff is the highest among the listed codes. - The April 11, 2025 increase also applies here.

✅ HS CODE: 8504409540

Product Description:

- Inverter power supplies (used in industrial or specialized applications)

Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This code is for inverter power supplies, which may differ from general inverters. - The base tariff is 0.0%, but the April 11, 2025 increase still applies.

📌 Proactive Advice for Importers:

- Verify the exact product type (e.g., micro-inverter, inverter generator, or general inverter) to ensure correct classification.

- Check the unit price and material composition, as this may affect classification or duty calculation.

- Confirm required certifications (e.g., CE, RoHS, or other local regulations) before import.

- Monitor the April 11, 2025 tariff change and plan accordingly for cost estimation and compliance.

Let me know if you need help determining which HS code applies to your specific inverter model.

Customer Reviews

I found the explanation of HS code 3925 and its relevance to plastic doors very informative. Highly recommend this page!

The information on plastic builder's doors was detailed and accurate. A bit technical, but that's expected for this topic.

Tariff rate 5% for the US is clearly stated. Perfect for someone like me who's new to international trade.

The breakdown of HS code 3925 was very helpful. I wish there were more examples for different product types though.

I was looking for details on exporting plastic doors and this page had exactly what I needed. Great resource!