| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8539510000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 9033002000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8486900000 | Doc | 80.0% | CN | US | 2025-05-12 |

Okay, let's break down the HS codes and tax implications for your "LED modules" declaration. Here's a structured analysis to help you understand the classification and potential duties:

Understanding HS Codes – A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. The first 6 digits are generally consistent worldwide, while countries can add further digits for more specific categorization. Here's what the digits typically mean:

- First 2 Digits (Chapter): Broadly defines the product category.

- Next 4 Digits (Heading): More specific classification within the chapter.

- Further Digits (Subheading/Part Number): Even more detailed classification.

Analysis of Your LED Module HS Codes

Let's examine each code provided:

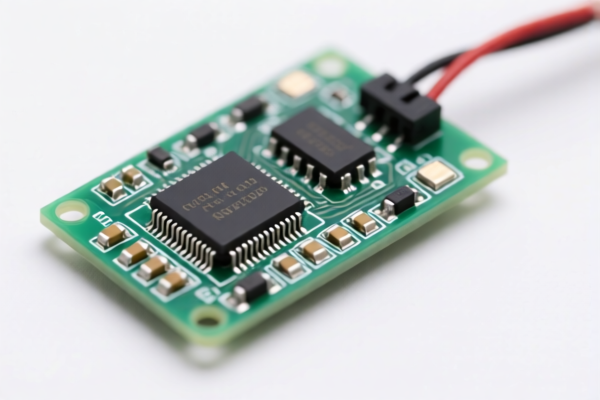

1. HS Code: 8539.51.00.00 – Light-emitting diode (LED) modules

- Chapter 85: Electrical machinery and equipment and parts thereof; sound recording or reproducing apparatus, television-image transmission or reproduction apparatus, and parts and accessories of such articles.

- Heading 8539: Electrical connectors, electrical relays, electrical switches, fuses and fuse combinations and similar elements; electrical conductors.

- Subheading 8539.51: Connectors for use with electrical machinery, equipment and apparatus.

- Tax Details:

- Basic Duty: 0.0%

- Additional Tariff: 25.0% (increasing to 30% after April 2, 2025)

- Total Tax: 55.0%

- Notes: This code seems to classify the LED modules as electrical components, specifically connectors. It's important to confirm if this accurately reflects the primary function of the modules.

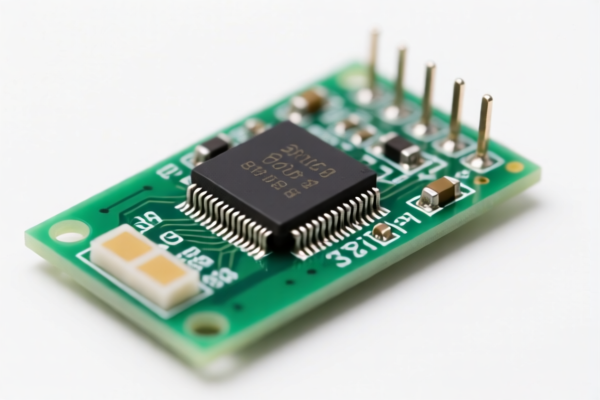

2. HS Code: 9033.00.20.00 – Parts and accessories (not specified or included elsewhere in this chapter) for machines, appliances, instruments or apparatus of chapter 90: --> Light-emitting diode (LED) backlights modules, the foregoing which are consisting of one or more LEDs and one or more connectors and are mounted on a printed circuit or other similar substrate, and other passive components, whether or not combined with optical components or protective diodes, and used as backlights illumination for liquid crystal displays (LCDs)

- Chapter 90: Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof.

- Heading 9033: Parts and accessories for machines, appliances, instruments or apparatus of chapter 90.

- Subheading 9033.00.20: Specifically for parts and accessories used in optical instruments.

- Tax Details:

- Basic Duty: 0.0%

- Additional Tariff: 25.0% (increasing to 30% after April 2, 2025)

- Total Tax: 55.0%

- Notes: This code is more specific, classifying the modules as parts for optical instruments (specifically LCD backlights). If your modules are specifically designed and sold as backlight units for LCDs, this code might be more appropriate.

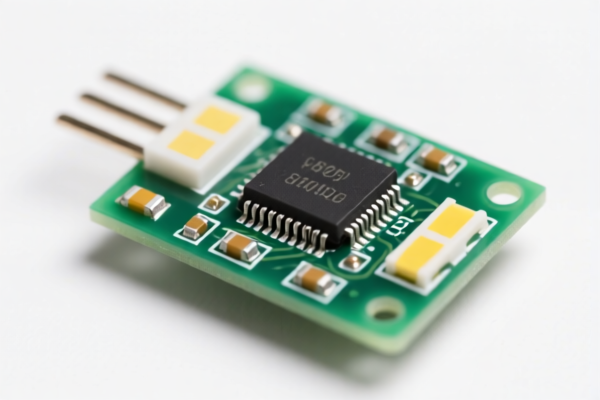

3. HS Code: 8486.90.00.00 – Machines and apparatus of a kind used solely or principally for the manufacture of semiconductor boules or wafers, semiconductor devices, electronic integrated circuits or flat panel displays; machines and apparatus specified in note 11(C) to this chapter; parts and accessories: --> Parts and accessories

- Chapter 84: Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof.

- Heading 8486: Machines and apparatus for the manufacture of semiconductor devices, flat panel displays, etc.

- Subheading 8486.90: Parts and accessories for these machines.

- Tax Details:

- Basic Duty: 0.0%

- Additional Tariff: 25.0% (increasing to 30% after April 2, 2025) – plus 25% additional tariff on steel/aluminum products.

- Total Tax: 80.0%

- Notes: This code applies if the modules are used in the manufacturing process of semiconductors or flat panel displays. The higher tax rate reflects the specialized nature of the equipment. Pay close attention to the steel/aluminum component – if your modules contain significant amounts of these materials, the 25% additional tariff will apply.

Recommendations & Key Considerations

- Primary Function: The most important factor is determining the primary function of the LED modules. Are they general electrical connectors, LCD backlight units, or components used in manufacturing processes?

- Material Composition: If you choose HS Code 8486.90.00.00, carefully analyze the material composition of the modules. If they contain steel or aluminum, the additional 25% tariff will apply.

- Detailed Description: Provide a very detailed description of the modules to customs officials, including their intended use, specifications, and material composition.

- Certification: Depending on the application, you may need certifications (e.g., CE, RoHS, UL). Check the import requirements for your destination country.

- Invoice Accuracy: Ensure the invoice accurately reflects the value and description of the goods.

- Consult a Broker: I highly recommend consulting with a customs broker in your destination country. They can provide expert guidance on HS code classification and ensure compliance with all import regulations.

Disclaimer: I am an AI assistant and cannot provide definitive customs advice. This information is for general guidance only. Always consult with a qualified customs broker for accurate and up-to-date information.

Customer Reviews

No reviews yet.