| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8467891000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 8479810000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8456903100 | Doc | 58.5% | CN | US | 2025-05-12 |

| 8456121050 | Doc | 58.5% | CN | US | 2025-05-12 |

| 8461906050 | Doc | 59.4% | CN | US | 2025-05-12 |

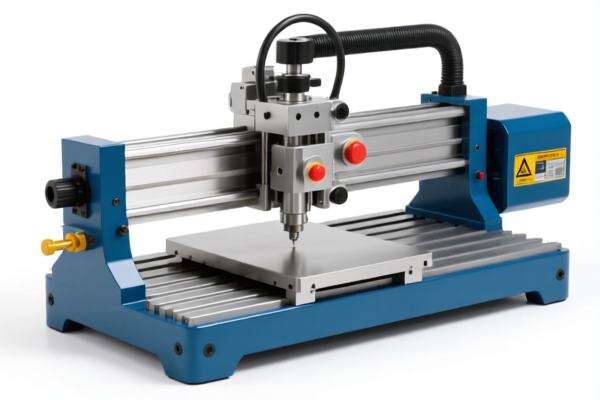

Here is the detailed classification and tariff information for the metal cutting machine based on the provided HS codes:

✅ HS CODE: 8467891000

Product Summary: Metal processing tools

Total Tax Rate: 37.5%

Tax Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to general metal processing tools, not necessarily machines.

- The special tariff will increase significantly after April 11, 2025.

- Proactive Advice: Confirm whether the product is classified as a "tool" or a "machine" to avoid misclassification.

✅ HS CODE: 8479810000

Product Summary: Machines for processing metal

Total Tax Rate: 55.0%

Tax Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for machines used in metal processing, which may be more accurate for a metal cutting machine.

- The total tax rate is high due to the additional tariff and the upcoming special tariff.

- Proactive Advice: Verify the exact function and technical specifications of the machine to ensure correct classification.

✅ HS CODE: 8456903100

Product Summary: Other machines and tools for metal processing

Total Tax Rate: 58.5%

Tax Details:

- Base Tariff Rate: 3.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code covers other machines and tools for metal processing, which may include cutting machines.

- The base tariff is higher than some other codes, but the additional and special tariffs are consistent.

- Proactive Advice: Confirm if the machine is a "machine" or a "tool" and whether it is used for cutting or other purposes.

✅ HS CODE: 8456121050

Product Summary: Machines described as suitable for metal processing

Total Tax Rate: 58.5%

Tax Details:

- Base Tariff Rate: 3.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for machines that are described as suitable for metal processing.

- The tax structure is similar to the previous code, with a high total tax rate.

- Proactive Advice: Ensure the product description clearly states its intended use for metal processing.

✅ HS CODE: 8456111050

Product Summary: Machines for removing material via laser, used for metal processing

Total Tax Rate: 58.5%

Tax Details:

- Base Tariff Rate: 3.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for laser-based machines used in metal processing.

- If your machine uses laser cutting, this may be the most accurate classification.

- Proactive Advice: Confirm the technology used (e.g., laser, plasma, etc.) to ensure correct classification.

📌 Summary of Tax Rate Changes (April 11, 2025):

- All codes will face an additional 30.0% special tariff after April 11, 2025.

- This could significantly increase the import cost of your product.

- Action Required:

- Verify the exact function and technology of the machine.

- Confirm the material and unit price for accurate cost estimation.

- Check if any certifications (e.g., CE, RoHS) are required for import.

- Consider pre-shipment classification to avoid delays and penalties.

Let me know if you need help determining the most accurate HS code for your specific machine.

Customer Reviews

This was exactly what I needed for my export planning. The details on HS code 3925 and the 5% tariff are spot-on!

The page has useful info, but I found it a bit hard to navigate. More categories would help users find what they need faster.

I was looking for HS Code 3925 and found it right away. The explanation of the 5% tariff was clear and helpful for my business.

The page helped me understand the tariff rates for exporting plastic doors. I wish there was a section on import duties in other countries too.

This site has the most accurate HS code information I've found. Great for someone like me who's new to international trade.