| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8484100000 | Doc | 57.5% | CN | US | 2025-05-12 |

| 8484200000 | Doc | 58.9% | CN | US | 2025-05-12 |

| 8484900000 | Doc | 57.5% | CN | US | 2025-05-12 |

| 9403999045 | Doc | 105.0% | CN | US | 2025-05-12 |

| 8484100000 | Doc | 57.5% | CN | US | 2025-05-12 |

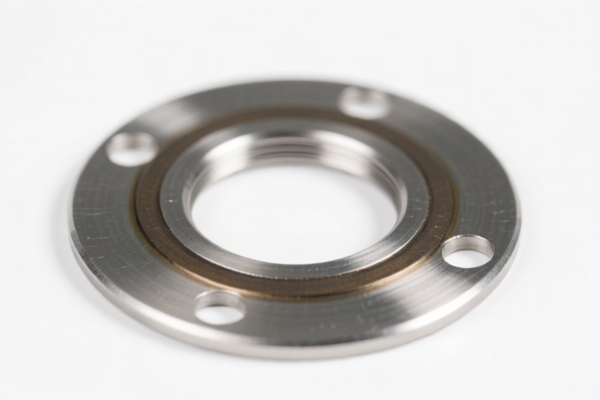

Based on the provided HS codes and product description ("metal gasket"), here is a structured classification and tariff summary for customs compliance purposes:

✅ HS CODE: 8484100000

Product Description: Metal gaskets made of different materials or combinations, including those in sets or categories, packed in bags, envelopes, or similar packaging; mechanical seals.

- Base Tariff Rate: 2.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.5%

- Notes:

- This code applies to gaskets made of multiple materials or combinations.

- Ensure the product is not classified under other HS codes (e.g., 8484200000 or 9403999045) based on specific composition and packaging.

- Proactive Advice: Verify the exact composition of the gasket (e.g., whether it includes steel or aluminum) as this may trigger additional anti-dumping duties or higher tariffs.

✅ HS CODE: 8484900000

Product Description: Gaskets and similar joints made of metal sheet combined with other materials.

- Base Tariff Rate: 2.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.5%

- Notes:

- This code is for gaskets made of metal sheet combined with other materials.

- Similar to 8484100000, but may differ in composition or use.

- Proactive Advice: Confirm whether the gasket is a single unit or part of a set, as this may affect classification.

✅ HS CODE: 8484200000

Product Description: Gaskets made of metal sheet combined with other materials, or sets of gaskets made of different materials.

- Base Tariff Rate: 3.9%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.9%

- Notes:

- This code applies to gaskets made of different materials or as part of a set.

- The base tariff is slightly higher than the previous codes.

- Proactive Advice: Confirm if the product is a set or individual unit, as this can change the applicable HS code.

✅ HS CODE: 9403999045

Product Description: Other parts of furniture, specifically metal parts.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Steel/Aluminum Additional Tariff: 50.0%

- Total Tax Rate: 105.0%

- Notes:

- This code is not applicable to gaskets unless the product is classified as a furniture part.

- Proactive Advice: Avoid misclassification. If the gasket is not part of furniture, this code should not be used.

📌 Key Considerations for Customs Compliance:

- Material Verification: Confirm the exact composition of the gasket (e.g., steel, aluminum, or other materials) as this may trigger additional tariffs.

- Unit Price and Certification: Check if any certifications (e.g., ISO, RoHS) are required for import.

- Packaging and Presentation: If the gasket is sold in sets or with specific packaging, ensure the HS code reflects this.

- Tariff Changes: Be aware that additional tariffs increase to 30% after April 11, 2025, and steel/aluminum products may face an extra 50% tariff.

🛑 Critical Reminder:

If your product is a metal gasket, HS CODE 8484100000 or 8484900000 is most likely the correct classification. Avoid using HS CODE 9403999045 unless the product is explicitly a furniture part. Always verify the product's composition and packaging before finalizing the HS code.

Customer Reviews

Great resource for anyone exporting plastic builder's doors. The HS Code and tariff info were spot-on and very easy to understand.

The info is there, but the layout is a bit confusing. Took me a while to find the HS Code I needed, but the content was accurate.

This site made it easy to understand the 5% tariff rate for plastic doors. Definitely saved me time when preparing my export paperwork.

The page has good trade details for exporting. I would have liked a bit more about customs documentation, but it's still a helpful tool.

The tariff rate details for the US were helpful, though I wish there were more countries covered. Still, a solid resource.