| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8482101080 | Doc | 57.4% | CN | US | 2025-05-12 |

| 8482105004 | Doc | 64.0% | CN | US | 2025-05-12 |

| 8482105064 | Doc | 64.0% | CN | US | 2025-05-12 |

| 8482991550 | Doc | 60.8% | CN | US | 2025-05-12 |

| 8482992580 | Doc | 60.8% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for the declared product "bearing" based on the provided HS codes:

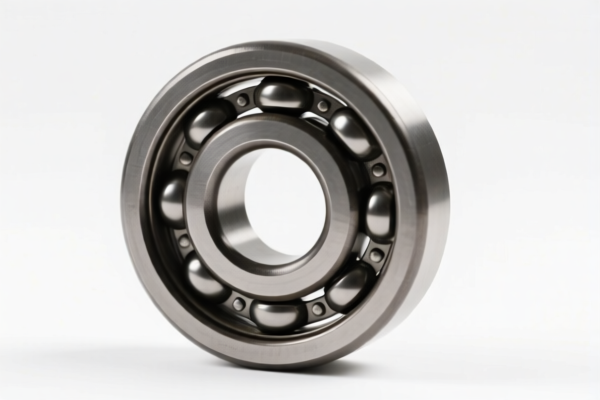

📌 HS CODE: 8482101080

Product Description: Ball bearings with integral shaft

Total Tax Rate: 57.4%

- Base Tariff Rate: 2.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

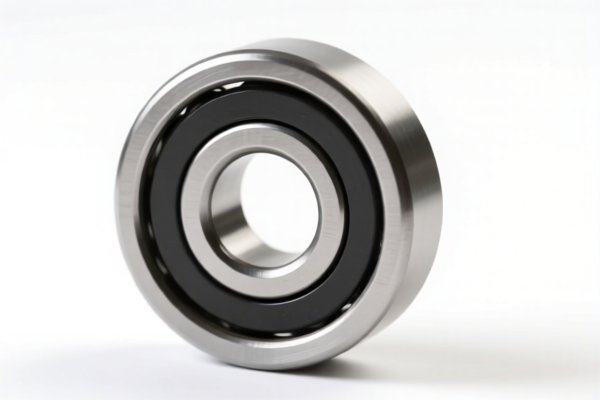

📌 HS CODE: 8482105004

Product Description: Ungrinded ball bearings

Total Tax Rate: 64.0%

- Base Tariff Rate: 9.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 HS CODE: 8482105064

Product Description: Radial ball bearings

Total Tax Rate: 64.0%

- Base Tariff Rate: 9.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 HS CODE: 8482101040

Product Description: Ball bearings with outer diameter not exceeding 30 mm

Total Tax Rate: 57.4%

- Base Tariff Rate: 2.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 HS CODE: 8482991550

Product Description: Other parts of bearings

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes:

-

April 11 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be imposed on all these HS codes. This is a time-sensitive policy and may significantly increase the total import cost.

-

Anti-dumping duties: These products may be subject to anti-dumping duties on iron and aluminum components, depending on the origin and specific regulations. Please verify the material composition and country of origin.

✅ Proactive Advice:

- Verify Material and Unit Price: Confirm the exact material (e.g., steel, aluminum) and unit price to ensure correct classification and duty calculation.

- Check Required Certifications: Some bearings may require technical certifications or origin documentation (e.g., Form A, EUR1) for preferential tariff treatment.

- Consult a Customs Broker: For complex cases, especially with multiple HS codes or high-value imports, it is recommended to consult a professional customs broker or trade compliance expert.

Let me know if you need help determining the correct HS code based on your product specifications.

Customer Reviews

This page gave me all the details I needed about exporting plastic doors to the US. Highly recommend it.

The tariff rate explanation was helpful, but I had to look up some of the trade terms elsewhere.

I was looking for HS Code 3925 info and found it right here. Perfect resource for my business.

The HS code details are spot on. Would have been better if there were links to related products too.

This page was super helpful for understanding the import tariffs on plastic doors. Saved me a lot of time.