| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4810923000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810291035 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810996500 | Doc | 55.0% | CN | US | 2025-05-12 |

| 9504400000 | Doc | 30.0% | CN | US | 2025-05-12 |

| 4810145000 | Doc | 55.0% | CN | US | 2025-05-12 |

Here is the classification and tariff information for paper cards based on the provided HS codes:

✅ HS CODE: 4810923000

Product Description:

- Paper cards coated with kaolin or other inorganic substances, used for non-punched cards in card machines.

- Typically used in automated systems like ID cards or access control systems.

Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 55.0%

Key Notes:

- This code applies specifically to non-punched cards used in card machines.

- Ensure the product is not punched and is not used for printing or writing.

✅ HS CODE: 4810291035

Product Description:

- Coated paper (with kaolin or other inorganic substances) used for writing, printing, or other graphic purposes.

- Typically used for business cards, labels, or printed materials.

Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 55.0%

Key Notes:

- This code is for printed or printable paper.

- Confirm the intended use (e.g., for printing, not for card machines).

✅ HS CODE: 4810996500

Product Description:

- Paper products coated with kaolin or other inorganic substances, not otherwise specified.

- A catch-all code for paper products not covered by more specific codes.

Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 55.0%

Key Notes:

- Use this code only when the product does not match the more specific codes above.

- Verify the material composition and intended use to avoid misclassification.

✅ HS CODE: 4810145000

Product Description:

- Coated paper for writing or printing, with specific size limitations (e.g., one side ≤ 435mm, the other ≤ 297mm).

- Commonly used for business cards, labels, or small printed materials.

Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 55.0%

Key Notes:

- Ensure the physical dimensions of the product meet the size criteria.

- This code is not for card machine cards.

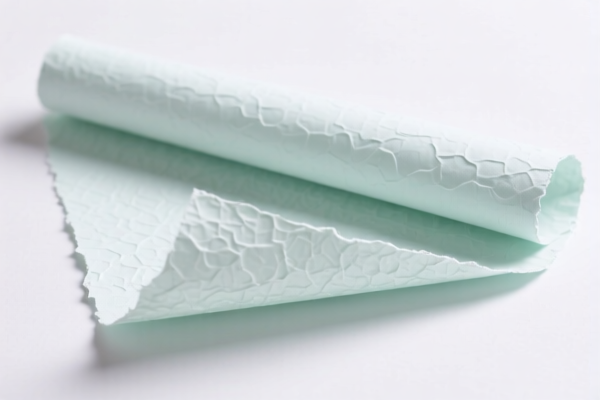

✅ HS CODE: 4810131140

Product Description:

- Coated paper or paperboard in rolls, used for writing or printing, not containing more than 10% mechanical or chemi-mechanical pulp.

- Commonly used for label stock, printed paper rolls, etc.

Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 55.0%

Key Notes:

- This code applies to paper rolls, not cut sheets.

- Confirm the pulp content to avoid misclassification.

📌 Proactive Advice for Importers:

- Verify the product’s use (e.g., for card machines, printing, or general use).

- Check the physical dimensions if using code 4810145000.

- Confirm the pulp content if using code 4810131140.

- Check for certifications (e.g., environmental, safety, or quality standards) if required by the importing country.

- Monitor the April 11, 2025 tariff change to avoid unexpected costs.

- Consult a customs broker if unsure about classification or documentation.

Let me know if you need help determining which code best fits your specific product.

Customer Reviews

No reviews yet.