| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8441100000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8441900000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8419891000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8439200010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8439200090 | Doc | 55.0% | CN | US | 2025-05-12 |

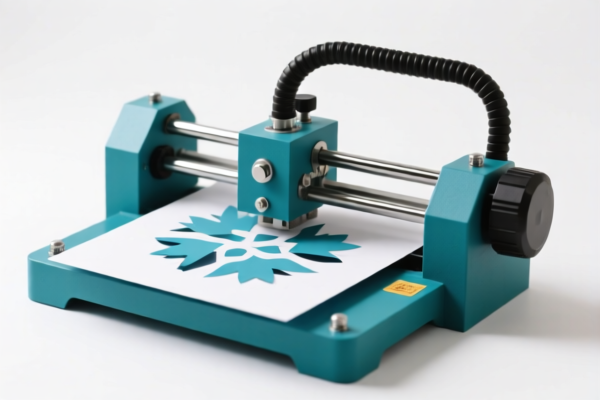

Here is the classification and tariff information for paper cutter products based on the provided HS codes:

✅ HS CODE: 8441100000

Product Description:

- Paper-cutting machines, including digital paper cutters, small paper cutters, electric paper cutters, large paper cutters, hydraulic paper cutters, etc.

Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This code applies to machines used for cutting paper, not just blades or parts. - Proactive Advice: Confirm whether the product is a complete machine or a component. If it's a machine, this is the correct code.

✅ HS CODE: 8441900000

Product Description:

- Paper-cutting blades, parts of paper-cutting machines, etc.

Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This code applies to parts or blades used in paper-cutting machines. - Proactive Advice: If your product is a blade or component, this is the correct code.

✅ HS CODE: 8419891000

Product Description:

- Paper-cutting equipment, paper slitting machines, etc.

Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This code is for machines used for cutting or slitting paper. - Proactive Advice: If your product is a machine used for cutting or slitting paper, this may be applicable.

✅ HS CODE: 8439200010

Product Description:

- Paper trimming machines.

Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This code is for machines used for trimming paper. - Proactive Advice: If your product is a trimming machine, this is the correct code.

✅ HS CODE: 8439200090

Product Description:

- Paper slitting machines.

Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This code is for machines used for slitting paper. - Proactive Advice: If your product is a slitting machine, this is the correct code.

📌 Important Reminders:

- All listed products are subject to a total tax rate of 55.0%, including the special tariff imposed after April 11, 2025.

- Verify the product type (machine, blade, component) to ensure correct classification.

- Check if any anti-dumping duties apply based on the origin of the product (not shown in current data).

- Confirm the material and unit price for accurate customs valuation.

- Check if any certifications (e.g., CE, RoHS) are required for import.

Let me know if you need help determining which code applies to your specific product.

Customer Reviews

No reviews yet.