| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8439200010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8203300000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8213006000 | Doc | 8¢ each + 8%+30.0% | CN | US | 2025-05-12 |

| 8213003000 | Doc | 1.7¢ each + 4.3%+30.0% | CN | US | 2025-05-12 |

| 8213003000 | Doc | 1.7¢ each + 4.3%+30.0% | CN | US | 2025-05-12 |

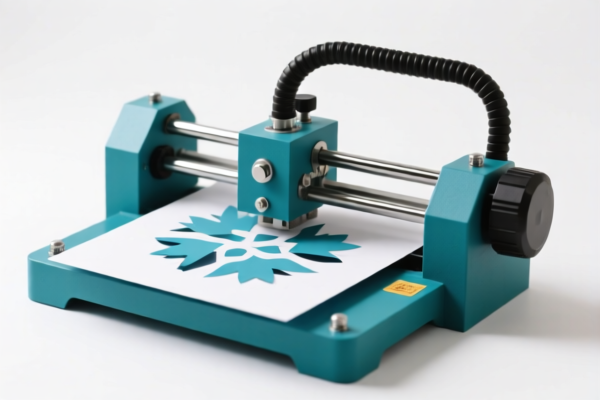

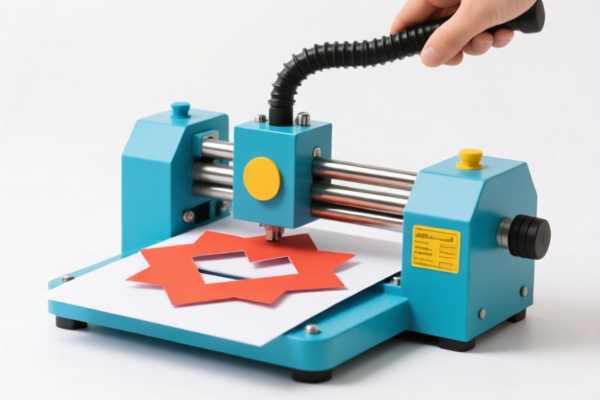

Here is the classification and tariff information for paper cutting machines, based on the provided HS codes and tariff details:

✅ HS CODE: 8439200010

Product Description: Paper cutting machines used for manufacturing pulp from cellulose materials, or for manufacturing or processing paper or cardboard.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This classification applies to machines used in the paper or cardboard manufacturing process.

- Time-sensitive alert: Tariff increases to 30.0% after April 11, 2025.

- Proactive Advice: Confirm the machine's function and whether it is used for paper or cardboard production. Ensure proper documentation for customs clearance.

✅ HS CODE: 8213003000

Product Description: Scissors or shears for cutting paper, valued at less than $1.75 per dozen.

Tariff Summary:

- Base Tariff: 1.7¢ per unit + 4.3%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 1.7¢ each + 4.3% + 30.0%

Key Notes:

- This classification applies to low-value paper-cutting scissors.

- Time-sensitive alert: Tariff increases to 30.0% after April 11, 2025.

- Proactive Advice: Verify the unit price and ensure it falls below $1.75 per dozen to qualify for this rate.

✅ HS CODE: 8213006000

Product Description: Scissors or shears for cutting paper, valued at more than $1.75 per dozen, including parts in base metal.

Tariff Summary:

- Base Tariff: 8¢ per unit + 8%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 8¢ each + 8% + 30.0%

Key Notes:

- This classification applies to higher-value paper-cutting scissors.

- Time-sensitive alert: Tariff increases to 30.0% after April 11, 2025.

- Proactive Advice: Confirm the unit price and ensure it exceeds $1.75 per dozen to qualify for this rate.

✅ HS CODE: 8203300000

Product Description: Manual shears or similar hand tools.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This classification applies to manual cutting tools like shears.

- Time-sensitive alert: Tariff increases to 30.0% after April 11, 2025.

- Proactive Advice: Confirm the function and material of the tool to ensure correct classification.

✅ HS CODE: 8432800080

Product Description: Lawn mowers, including parts, used for agricultural, horticultural, or forestry purposes.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This classification applies to lawn mowers, not paper-cutting machines.

- Time-sensitive alert: Tariff increases to 30.0% after April 11, 2025.

- Proactive Advice: Ensure the product is not a lawn mower to avoid misclassification.

📌 Final Recommendations:

- Verify the product type (machine vs. hand tool) and material (e.g., base metal, plastic) to ensure correct HS code.

- Check the unit price for scissors to determine the correct classification (8213003000 vs. 8213006000).

- Monitor the April 11, 2025 tariff change and adjust pricing or documentation accordingly.

- Confirm certifications (e.g., CE, RoHS) if required for import.

Customer Reviews

The page was very informative, but I found the layout a bit dense. Still, the information was exactly what I needed.

The explanation of the 5% tariff rate was spot on. It helped me understand the cost implications of exporting my product.

I was looking for HS code info for plastic doors, and this page had it all. Great resource for anyone exporting to the US.

The section on trade regulations was helpful, but I wish there were more examples of how the tariff applies in different scenarios.

This page gave me all the details I needed for my export paperwork. The HS code and tariff info were presented clearly and concisely.