| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8544422000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 9001100070 | Doc | 61.7% | CN | US | 2025-05-12 |

| 9001100085 | Doc | 61.7% | CN | US | 2025-05-12 |

| 8544422000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8544422000 | Doc | 55.0% | CN | US | 2025-05-12 |

Based on the provided HS code classifications for patch cords, here is a structured and professional summary of the customs compliance and tariff information:

✅ Product Classification Overview: Patch Cord

Product Description:

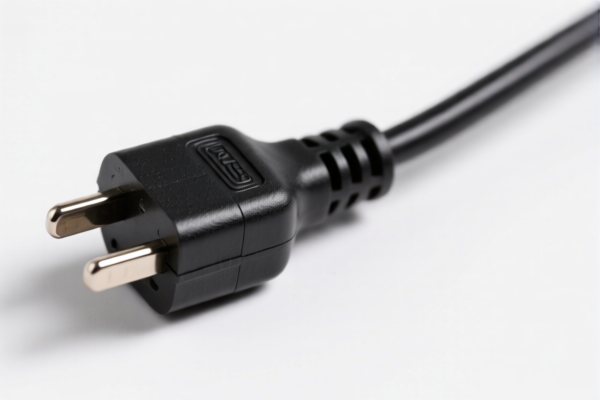

Patch cords are typically classified under insulated wires and cables, including fiber optic cables, and may be classified under different HS codes depending on their composition and use.

📌 HS Code Classification and Tariff Details

1. HS Code: 8544.42.20.00

Description:

- Insulated wires and cables (including coaxial cables) and other insulated conductors, whether or not fitted with connectors; fiber optic cables made of individually sheathed fibers, whether or not assembled with conductors or fitted with connectors.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

Key Notes: - This code is repeated multiple times in your input, indicating it is the primary classification for patch cords made of fiber optic cables. - April 11 Special Tariff applies after April 11, 2025, increasing the total tax rate from 50.0% to 55.0%.

2. HS Code: 9001.10.00.70

Description:

- Optical fibers and fiber bundles under the classification of optical cables.

Tariff Summary:

- Base Tariff Rate: 6.7%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.7%

Key Notes: - This code applies specifically to optical fibers and fiber bundles. - April 11 Special Tariff increases the total tax rate from 56.7% to 61.7%.

3. HS Code: 9001.10.00.85

Description:

- Optical fibers, fiber bundles, and cables.

Tariff Summary:

- Base Tariff Rate: 6.7%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.7%

Key Notes: - This code is similar to the previous one but may apply to cables that include optical fibers. - April 11 Special Tariff also applies here, increasing the total tax rate from 56.7% to 61.7%.

⚠️ Important Alerts and Compliance Notes

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed on all products classified under these HS codes after April 11, 2025.

-

This could significantly increase the total tax burden, so importers should plan accordingly.

-

Anti-dumping duties:

- Not applicable for the products listed above (no mention of anti-dumping duties on iron or aluminum).

🛠️ Proactive Compliance Advice

- Verify Product Composition:

-

Confirm whether your patch cord is made of fiber optic cables or traditional insulated wires. This will determine the correct HS code.

-

Check Unit Price and Material:

-

The material composition (e.g., fiber optic vs. copper) and unit price may influence classification and tax treatment.

-

Certifications Required:

-

Ensure your product meets any customs or import certifications (e.g., CE, RoHS, or other relevant standards) depending on the destination country.

-

Consult a Customs Broker:

- For complex classifications or high-value shipments, consider working with a customs broker to ensure compliance and avoid delays.

📌 Summary of Tax Rates by HS Code

| HS Code | Base Tariff | Additional Tariff | Special Tariff (After 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|

| 8544.42.20.00 | 0.0% | 25.0% | 30.0% | 55.0% |

| 9001.10.00.70 | 6.7% | 25.0% | 30.0% | 61.7% |

| 9001.10.00.85 | 6.7% | 25.0% | 30.0% | 61.7% |

Let me know if you need help determining the correct HS code for your specific product or assistance with customs documentation.

Customer Reviews

No reviews yet.