Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909910 | Doc | 42.8% | CN | US | 2025-05-12 |

| 6909120000 | Doc | 59.0% | CN | US | 2025-05-12 |

| 7020006000 | Doc | 60.0% | CN | US | 2025-05-12 |

| 7017905000 | Doc | 61.7% | CN | US | 2025-05-12 |

| 7017200000 | Doc | 61.7% | CN | US | 2025-05-12 |

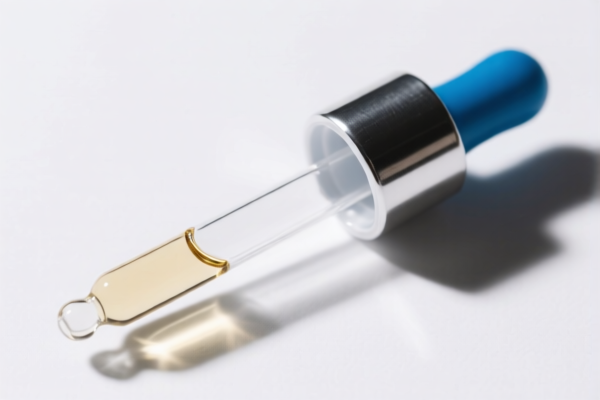

- HS CODE: 3926909910

- Product Classification: Plastic pipettes for laboratory use

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 42.8%

- Key Notes:

- This code applies to plastic pipettes used in laboratories.

- Be sure to confirm the material (plastic) and unit price for accurate classification.

- No anti-dumping duties apply to this product category.

- HS CODE: 6909120000

- Product Classification: Ceramic pipettes for laboratory use

- Base Tariff Rate: 4.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.0%

- Key Notes:

- This code applies to ceramic laboratory pipettes.

- Verify the material (ceramic) and intended use (laboratory) for correct classification.

- No anti-dumping duties apply to this product category.

- HS CODE: 7020006000

- Product Classification: Glass pipettes

- Base Tariff Rate: 5.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.0%

- Key Notes:

- This code applies to general glass pipettes.

- Confirm the product is made of glass and not part of a more specific category (e.g., calibrated or laboratory-specific).

- No anti-dumping duties apply to this product category.

- HS CODE: 7017905000

- Product Classification: Laboratory glassware, including pipettes

- Base Tariff Rate: 6.7%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.7%

- Key Notes:

- This code covers laboratory, medical, or pharmaceutical glassware, whether calibrated or not.

- Ensure the product is intended for laboratory use and is made of glass.

- No anti-dumping duties apply to this product category.

- HS CODE: 7017200000

- Product Classification: Calibrated glass pipettes for laboratory use

- Base Tariff Rate: 6.7%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.7%

- Key Notes:

- This code is specific to calibrated glass pipettes used in laboratories.

- Confirm the product is calibrated and used for laboratory purposes.

- No anti-dumping duties apply to this product category.

Proactive Advice:

- Verify the material (plastic, ceramic, or glass) and intended use (laboratory, medical, or pharmaceutical) to ensure correct HS code classification.

- Check if certifications (e.g., ISO, CE, or FDA) are required for import into the destination country.

- Be aware of the April 11, 2025 tariff increase, which may significantly impact your total import cost.

- If importing large quantities, consider customs duty exemptions or preferential trade agreements that may apply.

Customer Reviews

No reviews yet.