Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3924905650 | Doc | 40.9% | CN | US | 2025-05-12 |

| 3924104000 | Doc | 33.4% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3924102000 | Doc | 44.0% | CN | US | 2025-05-12 |

| 3926901000 | Doc | 40.9% | CN | US | 2025-05-12 |

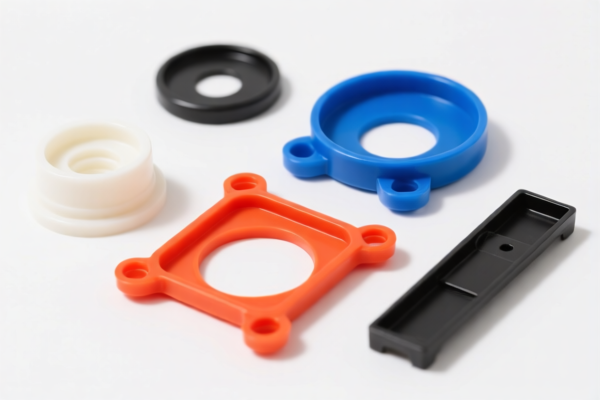

Based on the provided HS codes and tariff details, here is a structured classification and explanation for plastic bowls:

✅ HS CODE: 3924102000

Product Description: Plastic bowls (including soup bowls, dinner bowls, etc.), including sealed plastic bowls with lids and deepened design plastic bowls.

📌 Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (before April 11, 2025): 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 44.0%

⚠️ Important Notes:

- April 11 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be imposed on this product category.

- Anti-dumping duties: Not applicable for this product category.

- Material Verification: Confirm that the product is made entirely of plastic and not a composite material (e.g., plastic with metal parts), as this may affect classification.

✅ HS CODE: 3924104000

Product Description: Plastic tableware and kitchen utensils, other than those classified under other categories.

📌 Tariff Breakdown:

- Base Tariff Rate: 3.4%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.4%

⚠️ Important Notes:

- April 11 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be imposed.

- Material Verification: Ensure the product is not classified under a different HS code due to design or material differences.

- Certifications: No specific certifications are required for this category unless the product is exported to countries with additional import regulations.

✅ HS CODE: 3926901000

Product Description: Other plastic products, such as buckets and pails, including products from chapters 3901 to 3914.

📌 Tariff Breakdown:

- Base Tariff Rate: 3.4%

- Additional Tariff (before April 11, 2025): 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 40.9%

⚠️ Important Notes:

- April 11 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be imposed.

- Material and Design: This code is for general plastic products not classified elsewhere. Ensure your product does not fall under a more specific category like 3924102000.

- Certifications: No specific certifications are required unless the product is exported to countries with additional import regulations.

📌 Proactive Advice:

- Verify Material and Design: Confirm whether your plastic bowl is sealed, deepened, or part of a kitchen set, as this will determine the correct HS code.

- Check Unit Price: Tariff calculations depend on the declared value, so ensure accurate pricing.

- Monitor April 11, 2025: Be prepared for a significant increase in tariffs if your product falls under the affected HS codes.

- Consult a Customs Broker: For complex or high-value shipments, consult a customs expert to avoid misclassification and penalties.

Let me know if you need help determining the correct HS code for your specific product.

Customer Reviews

No reviews yet.