| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926901000 | Doc | 40.9% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3925100000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 4016990500 | Doc | 40.9% | CN | US | 2025-05-12 |

| 4008210000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4008294000 | Doc | 57.9% | CN | US | 2025-05-12 |

| 6702102000 | Doc | 38.4% | CN | US | 2025-05-12 |

| 6702104000 | Doc | 33.4% | CN | US | 2025-05-12 |

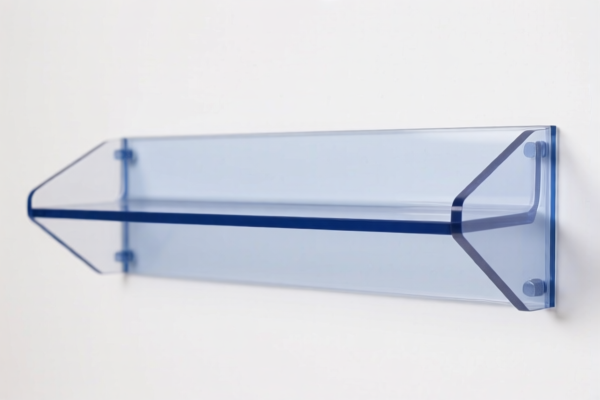

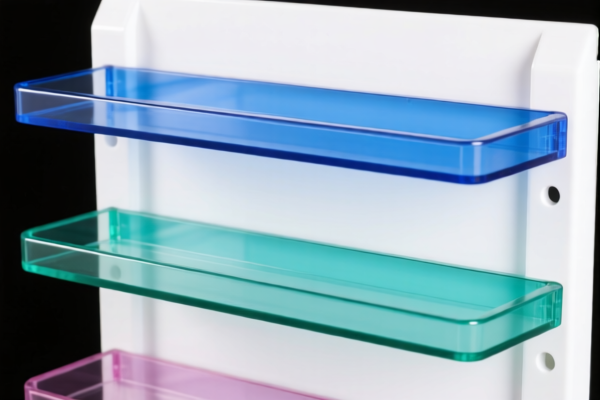

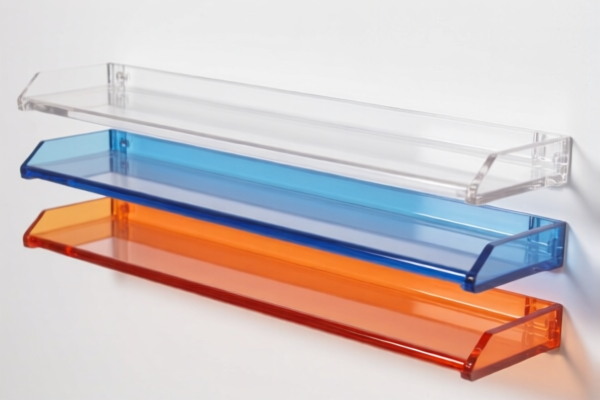

Plastic Rack

A plastic rack is a storage structure typically composed of multiple tiers, constructed primarily from various types of plastic polymers. They are utilized for organizing and holding a diverse range of items.

Material

The most common plastics used in rack construction include:

- Polypropylene (PP): Known for its high chemical resistance, affordability, and flexibility. Frequently used for general-purpose racks.

- Polyethylene (PE): Offers good impact resistance and is often employed in heavy-duty applications.

- Acrylonitrile Butadiene Styrene (ABS): Provides a balance of strength, rigidity, and impact resistance, suitable for indoor use.

- Polyvinyl Chloride (PVC): Durable and water-resistant, making it appropriate for damp environments.

Purpose

Plastic racks serve a broad range of organizational needs, including:

- General Storage: Holding household items, tools, supplies, or inventory.

- Display: Showcasing products in retail settings or for promotional purposes.

- Drying: Providing a platform for air-drying dishes, glassware, or laundry.

- Transport: Facilitating the movement of items within a facility or during shipping (often integrated with wheels or handles).

Function

The primary function of a plastic rack is to elevate items off the ground or a surface, maximizing space utilization and improving accessibility. Key functional characteristics include:

- Load Capacity: The amount of weight the rack can safely support. This varies significantly based on the plastic type, rack dimensions, and construction.

- Stackability: Many plastic racks are designed to stack securely, increasing storage density.

- Durability: Resistance to impacts, chemicals, and weathering, depending on the plastic material.

- Easy Cleaning: Smooth plastic surfaces are typically easy to wipe down and sanitize.

Usage Scenarios

- Residential: Garages, kitchens, pantries, laundry rooms for organizing household goods.

- Retail: Stores for displaying merchandise, backrooms for inventory storage.

- Commercial: Warehouses, factories, offices for storing and transporting materials.

- Laboratories: Holding lab equipment, glassware, and supplies.

- Food Service: Drying dishes, storing food containers, or organizing supplies.

Common Types

- Shelving Racks: Multi-tiered racks with flat surfaces for general storage.

- Dish Drying Racks: Designed with drainage features for drying dishes and cutlery.

- Coat Racks: Featuring hooks or bars for hanging clothing.

- Garage Storage Racks: Heavy-duty racks for storing tools, bins, and other garage items.

- Mobile Racks: Equipped with wheels for easy movement.

- Stackable Bins with Racks: Combining bins and racks for organized storage of smaller items.

- Wall-Mounted Racks: Fixed to a wall to save floor space.

The declared goods are a plastic rack, likely used for storage, organization, or display. Its function is to provide a structured support system for various items. Application scenarios include homes, warehouses, retail stores, and industrial settings.

The following HS codes are relevant based on the provided reference material:

-

3926901000: This code falls under Chapter 39: Plastics and articles thereof. Specifically, it covers Heading 3926: Other articles of plastics and articles of other materials of headings 3901 to 3914. The Subheading 3926901000 refers to "Other: Buckets and pails". While not a direct match for a rack, it indicates the broader category of plastic articles. The total tax rate is 40.9%, comprised of a 3.4% base tariff, a 7.5% additional tariff, and a 30.0% additional tariff effective after April 2, 2025.

-

3926909989: Also within Chapter 39: Plastics and articles thereof, Heading 3926: Other articles of plastics and articles of other materials of headings 3901 to 3914. This Subheading 3926909989 covers "Other: Other". This is a more general category for plastic articles not specifically listed elsewhere. The total tax rate is 42.8%, consisting of a 5.3% base tariff, a 7.5% additional tariff, and a 30.0% additional tariff effective after April 2, 2025.

-

3925900000: This code is under Chapter 39: Plastics and articles thereof, Heading 3925: Builders' ware of plastics, not elsewhere specified or included. The Subheading 3925900000 refers to "Other". If the plastic rack is used in construction or as a building component, this code may be applicable. The total tax rate is 60.3%, comprised of a 5.3% base tariff, a 25.0% additional tariff, and a 30.0% additional tariff effective after April 2, 2025.

It is important to determine the precise function and application of the plastic rack to select the most accurate HS code. If the rack functions as a large container, 3925100000 (Builders' ware of plastics, not elsewhere specified or included: Reservoirs, tanks, vats and similar containers, of a capacity exceeding 300 liters) might be considered, with a total tax rate of 61.3% (6.3% base tariff, 25.0% additional tariff, and 30.0% additional tariff effective after April 2, 2025).

Customer Reviews

No reviews yet.