| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9001906000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3814005090 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3824829000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 7003120000 | Doc | 56.4% | CN | US | 2025-05-12 |

| 7005291810 | Doc | 14.5¢/m<sup>2</sup>+55.0% | CN | US | 2025-05-12 |

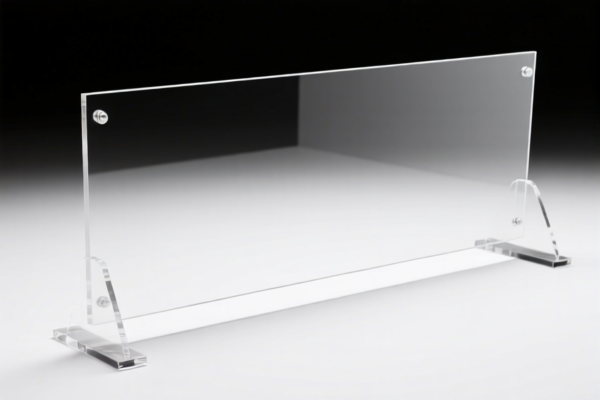

Here is the classification and tariff information for plexiglass (also known as acrylic glass) based on the provided HS codes and tariff details:

✅ HS CODE: 9001906000

Product Name: Organic glass mirror (e.g., plexiglass mirror)

Tariff Summary:

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to plexiglass mirrors or organic glass mirrors.

- No specific anti-dumping duties are mentioned for this product.

- Action Required: Confirm the product is indeed a mirror and not just raw plexiglass.

✅ HS CODE: 3814005090

Product Name: Organic solvent for glass cleaning

Tariff Summary:

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for organic solvents used in glass cleaning, not plexiglass itself.

- Not applicable to raw plexiglass or finished products made from it.

- Action Required: Ensure the product is not misclassified as a solvent.

✅ HS CODE: 3824829000

Product Name: Water glass (sodium silicate)

Tariff Summary:

- Total Tax Rate: 58.7%

- Breakdown:

- Base Tariff: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to water glass (silica-based), not plexiglass.

- Not applicable to acrylic or plexiglass products.

- Action Required: Confirm the product is not a chemical or industrial material.

✅ HS CODE: 7003120000

Product Name: Colored glass

Tariff Summary:

- Total Tax Rate: 56.4%

- Breakdown:

- Base Tariff: 1.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to colored glass, not plexiglass.

- Not applicable to acrylic or transparent plastic products.

- Action Required: Ensure the product is not misclassified as colored glass.

✅ HS CODE: 7005291810

Product Name: Transparent glass material

Tariff Summary:

- Total Tax Rate: 14.5¢/m² + 55.0%

- Breakdown:

- Base Tariff: 14.5¢/m² (ad valorem + specific duty)

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to transparent glass materials, not plexiglass.

- Not applicable to acrylic or plastic products.

- Action Required: Confirm the product is not misclassified as glass.

📌 Proactive Advice for Plexiglass Importers:

- Verify Material: Ensure the product is plexiglass (acrylic) and not misclassified as glass, solvent, or chemical.

- Check Unit Price: Some codes (e.g., 7005291810) include specific duties (e.g., 14.5¢/m²), which may affect total cost.

- Certifications Required: Confirm if any certifications (e.g., origin, environmental compliance) are needed for import.

- Watch for Tariff Changes: April 11, 2025, will trigger additional tariffs of 30.0% on all listed products.

- Consult Customs Broker: For accurate classification and duty calculation, especially if the product is a composite or finished good.

Let me know if you need help determining the correct HS code for your specific plexiglass product.

Customer Reviews

No reviews yet.