| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8536490080 | Doc | 57.7% | CN | US | 2025-05-12 |

| 8536610000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 8535908060 | Doc | 57.7% | CN | US | 2025-05-12 |

| 8535300080 | Doc | 57.7% | CN | US | 2025-05-12 |

| 8529909760 | Doc | 105.0% | CN | US | 2025-05-12 |

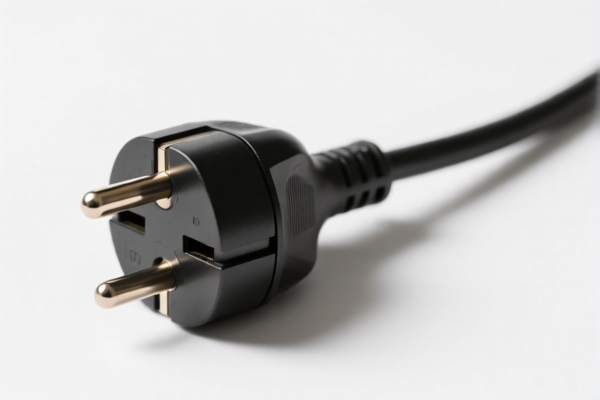

Product Classification and Tariff Information for "Plugs"

Based on the declared product "plugs", the following HS codes and tariff details are relevant. Please verify the exact product specifications (e.g., voltage, material, and function) to ensure accurate classification.

✅ HS Code: 8536490080

Description: Electrical equipment with a voltage not exceeding 1000V, used for switching or protecting circuits or establishing connections — plugs fall into this category.

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

✅ HS Code: 8536610000

Description: Electrical connection devices with voltage not exceeding 1000V — includes plugs, sockets, and lamp holders.

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

✅ HS Code: 8535908060

Description: Electrical connection devices with voltage exceeding 1000V — high-voltage plugs fall into this category.

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

✅ HS Code: 8535300080

Description: Electrical switches or protective devices for circuits with voltage exceeding 1000V, including plugs and connectors.

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

⚠️ HS Code: 8529909760

Description: Parts for equipment under headings 8524 to 8528 — not applicable to general plugs, but may apply to specialized parts for radio or radar equipment.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Additional Tariff for Steel/Aluminum Products: 50.0%

- Total Tax Rate: 105.0%

📌 Key Notes and Recommendations:

- Verify Product Specifications:

- Confirm whether the plug is for low voltage (≤1000V) or high voltage (>1000V).

-

Identify the material (e.g., steel, aluminum) if applicable, as this may trigger additional tariffs.

-

Check for Anti-Dumping Duties:

-

If the plug contains steel or aluminum, be aware of the 50% additional tariff under HS code 8529909760.

-

Special Tariff Alert:

- After April 11, 2025, an additional 30% tariff will be applied to most plug-related HS codes.

-

This may significantly increase the total tax burden.

-

Certifications Required:

- Ensure compliance with safety standards (e.g., CE, UL, RoHS) depending on the destination market.

-

Some countries may require customs documentation or product testing reports.

-

Action Plan:

- Immediately confirm the exact HS code based on product specs.

- Review the latest tariff schedule and import regulations for the destination country.

- Consult a customs broker if the product involves specialized components or high-value materials.

Let me know if you need help determining the exact HS code or calculating the final tax cost.

Customer Reviews

No reviews yet.