| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3902900050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5503400000 | Doc | 59.3% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3902300000 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the detailed classification and tariff information for polypropylene products based on the HS codes provided:

✅ HS CODE: 3902900050

Product Description: Polypropylene granules, polypropylene resin, polypropylene copolymers, and other primary forms of polypropylene products.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code covers raw or primary forms of polypropylene, such as granules or resins, used in manufacturing.

- Proactive Advice: Confirm the exact form of the product (e.g., granules, resin, or copolymer) to ensure correct classification.

✅ HS CODE: 5503400000

Product Description: Polypropylene synthetic short fibers, not carded, combed, or otherwise spun.

- Base Tariff Rate: 4.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.3%

Key Notes:

- This code applies to synthetic short fibers made from polypropylene, typically used in textiles or industrial applications.

- Proactive Advice: Ensure the product is in its raw fiber form and not further processed (e.g., woven fabric or yarn).

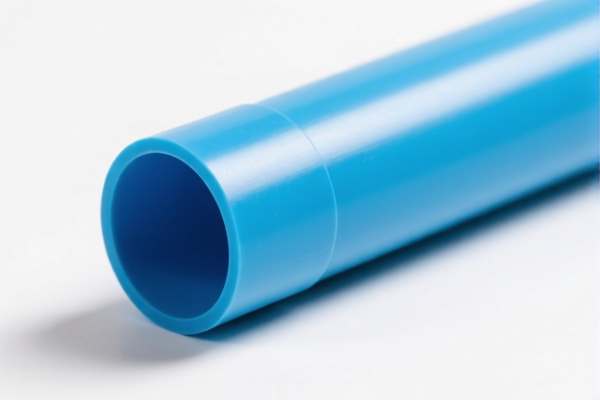

✅ HS CODE: 3917320050

Product Description: Polypropylene pipes, classified under plastic pipe products.

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

Key Notes:

- This code is for finished polypropylene pipes, typically used in construction or industrial piping systems.

- Proactive Advice: Verify the product is not a composite or reinforced pipe, which may fall under a different HS code.

✅ HS CODE: 3902300000

Product Description: Polypropylene powder, polypropylene building materials, and other primary forms of polypropylene products.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code includes polypropylene in powder form or used in building materials (e.g., molding compounds).

- Proactive Advice: Confirm the product is in its raw or unprocessed form and not a finished product.

📌 Important Alerts:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all four HS codes listed above.

- Anti-dumping duties: Not applicable for polypropylene products as of now.

- Certifications: Depending on the product type and destination, certifications such as REACH, RoHS, or customs documentation may be required.

- Unit Price Verification: Always confirm the unit price and material composition to avoid misclassification and potential penalties.

Let me know if you need help determining the correct HS code for a specific product or if you need assistance with customs documentation.

Customer Reviews

The note about certifications like REACH and RoHS was a great addition. It reminded me of the compliance requirements for exporting polypropylene products.

I found the section on HS Code 5503400000 very informative for synthetic short fibers. The tariff breakdown was straightforward and easy to follow.

The special tariff alert for April 11, 2025, was very useful. It helped me understand the additional 30% tax for all four HS codes listed.

The site has useful information, but I found the product images a bit generic. I had to look up more details about the polypropylene pipes elsewhere.

The detailed explanation of the 58.1% total tax rate for HS Code 3917320050 was exactly what I needed for exporting polypropylene pipes. Very helpful!