| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8544429010 | Doc | 57.6% | CN | US | 2025-05-12 |

| 8544110020 | Doc | 58.5% | CN | US | 2025-05-12 |

| 8415908085 | Doc | 88.9% | CN | US | 2025-05-12 |

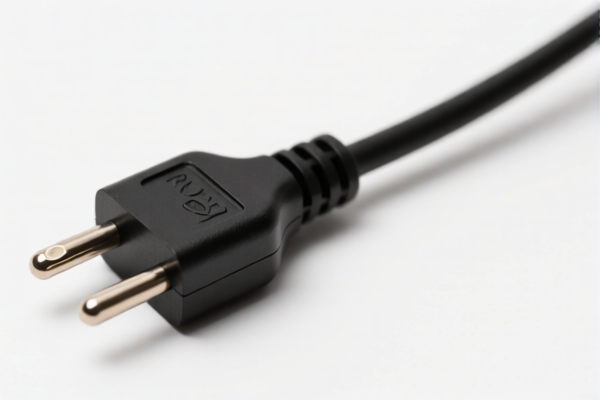

Here is the structured classification and tariff information for the power cord product based on the provided HS codes:

✅ HS CODE: 8544429010

Product Description:

- Power cords for home appliances, computers, TVs, workshop use, extension cords, power cords with switches, construction site power cords, office power cords, etc.

- Applies to insulated wires, cables, or other insulated conductors with connectors, for voltages not exceeding 1000V, and classified as extension cords under statistical note 6.

Tariff Information:

- Base Tariff Rate: 2.6%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.6%

Key Notes: - This code is specific to extension cords with connectors. - Time-sensitive alert: Additional tariffs increase to 30.0% after April 11, 2025. - Proactive Advice: Confirm the product is an extension cord with a connector and voltage ≤1000V.

✅ HS CODE: 8544110020

Product Description:

- Insulated wires (not exceeding diameter limits), not classified as extension cords.

Tariff Information:

- Base Tariff Rate: 3.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.5%

Key Notes: - This code is for insulated wires without connectors or as extension cords. - Time-sensitive alert: Additional tariffs increase to 30.0% after April 11, 2025. - Proactive Advice: Ensure the product is not classified as an extension cord (i.e., no connector or not used for extension purposes).

✅ HS CODE: 8415908085

Product Description:

- Power cords used specifically for air conditioners, classified as parts of air conditioning machines.

Tariff Information:

- Base Tariff Rate: 1.4%

- Additional Tariff (General): 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Additional Tariff on Steel/Aluminum Products: 50.0%

- Total Tax Rate: 88.9%

Key Notes: - This code is specific to air conditioner parts, including power cords. - Time-sensitive alert: Additional tariffs increase to 30.0% after April 11, 2025. - Anti-dumping duties: If the product contains steel or aluminum, an additional 50.0% tariff applies. - Proactive Advice: Verify if the power cord is used exclusively for air conditioners and check for any metal content that may trigger anti-dumping duties.

📌 Summary of Actions for Importers:

- Verify the product type (extension cord, general insulated wire, or air conditioner part).

- Check the voltage, connector type, and usage to determine the correct HS code.

- Confirm material composition (especially for steel or aluminum) to avoid unexpected anti-dumping duties.

- Review the effective date of tariffs (April 11, 2025) and plan accordingly.

- Check required certifications (e.g., CE, RoHS, etc.) for compliance in the destination market.

Let me know if you need help determining which HS code applies to your specific power cord.

Customer Reviews

No reviews yet.