| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4911914020 | Doc | 37.5% | CN | US | 2025-05-12 |

| 4911912040 | Doc | 30.0% | CN | US | 2025-05-12 |

| 4810145000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4802574085 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4911912020 | Doc | 30.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for the printed poster product based on the provided HS codes:

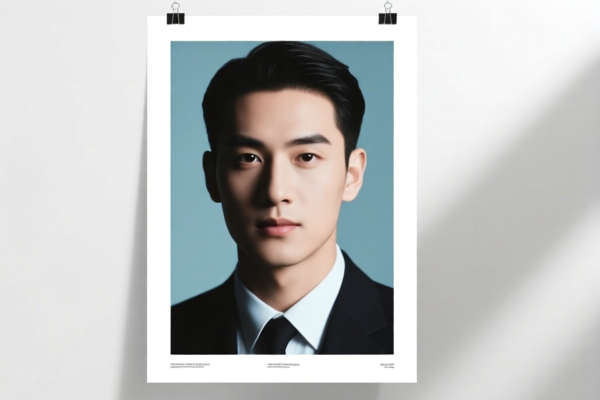

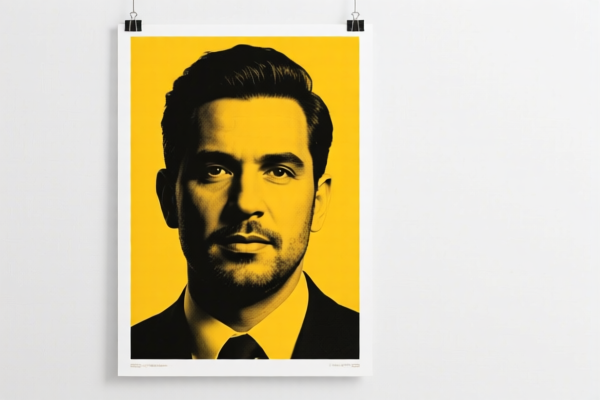

✅ HS CODE: 4911914020

Product Description: Import posters (not more than 20 years old) of images, designs, and photographs

Total Tax Rate: 37.5%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

Key Notes:

- This code applies to posters that are not more than 20 years old and are imported.

- The highest tax rate applies after April 11, 2025.

- Proactive Advice: Confirm the age of the poster and import status to ensure correct classification.

✅ HS CODE: 4911912040

Product Description: Other printed matter, including printed pictures and photographs

Total Tax Rate: 30.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

Key Notes:

- This code covers general printed matter such as printed pictures and photographs.

- The special tariff applies after April 11, 2025.

- Proactive Advice: Ensure the product is not classified under a more specific code (e.g., 4911914020).

✅ HS CODE: 4810145000

Product Description: Paper coated with kaolin or other inorganic substances, for writing, printing, or other graphic purposes

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: May apply if the paper is imported from certain countries (e.g., China, Vietnam, etc.)

Key Notes:

- This code applies to coated paper used for printing or graphic purposes.

- High tax rate due to additional tariffs and special tariffs after April 11, 2025.

- Proactive Advice: Verify material composition and origin to determine if anti-dumping duties apply.

✅ HS CODE: 4802574085

Product Description: Uncoated paper and paperboard, for writing, printing, or other graphic purposes

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: May apply if the paper is imported from certain countries (e.g., China, Vietnam, etc.)

Key Notes:

- This code applies to uncoated paper or paperboard used for printing or graphic purposes.

- High tax rate due to additional tariffs and special tariffs after April 11, 2025.

- Proactive Advice: Confirm material type and origin to determine if anti-dumping duties apply.

✅ HS CODE: 4911912020

Product Description: Lithographic posters, paper or paperboard not more than 0.51 mm thick, not more than 20 years old

Total Tax Rate: 30.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

Key Notes:

- This code applies to lithographic posters made of thin paper or paperboard and not more than 20 years old.

- The special tariff applies after April 11, 2025.

- Proactive Advice: Confirm the material thickness and age of the poster.

📌 Summary of Key Actions for Users:

- Verify the product's material, thickness, and age to ensure correct HS code classification.

- Check the origin of the product to determine if anti-dumping duties apply.

- Be aware of the April 11, 2025 tariff change, which may significantly increase the import cost.

- Review required certifications (e.g., origin, environmental compliance) depending on the product type and destination.

Let me know if you need help determining the correct HS code for your specific product!

Customer Reviews

No reviews yet.