| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9405490000 | Doc | 58.9% | CN | US | 2025-05-12 |

| 3926904800 | Doc | 33.4% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

Product Classification and Tariff Information for PVC-Related Goods

Based on the declared product "PVC", the following HS codes and tariff details are provided. Please note that the tariff rates are subject to change and are effective as of the latest regulations.

✅ HS CODE: 3904400000

Product Description: PVC particles, in primary form (polyvinyl chloride or other halogenated olefins).

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This classification applies to raw PVC particles, not finished products.

- Verify if the product is in its primary form (not compounded or processed).

✅ HS CODE: 3904220000

Product Description: PVC particles with plasticizers (plasticized polyvinyl chloride).

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This code applies to plasticized PVC, which is a processed form of PVC.

- Ensure the product contains plasticizers to confirm correct classification.

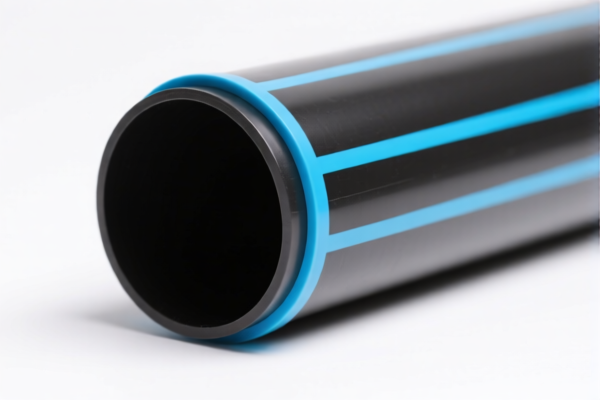

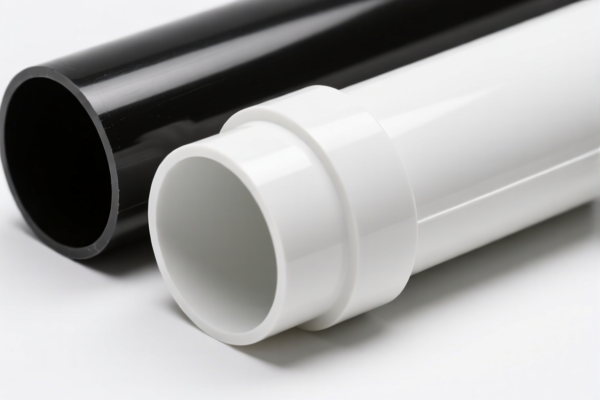

✅ HS CODE: 3916200020

Product Description: PVC plastic parts (e.g., molded or extruded products).

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Key Notes:

- This classification is for finished plastic products, not raw materials.

- Confirm the form and function of the product (e.g., whether it is a molded part or component).

✅ HS CODE: 3920435000

Product Description: PVC labels, classified under plastic sheets, films, foils, or strips.

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code applies to thin, flat PVC products such as labels or stickers.

- Ensure the product is not a molded or shaped part (which would fall under a different code).

✅ HS CODE: 3904100000

Product Description: PVC resin, in primary form (unplasticized).

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This classification is for PVC resin used in manufacturing, not for finished goods.

- Confirm the chemical form of the product (e.g., powder, granules, or pellets).

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm whether the product is raw PVC, plasticized, or finished.

- Check Unit Price and Certification: Some products may require customs valuation or certifications (e.g., for anti-dumping duties or environmental compliance).

- Monitor Tariff Changes: The special tariff after April 11, 2025, may significantly increase the total tax burden.

- Consult a Customs Broker: For complex classifications or large-volume imports, professional assistance is recommended to avoid misclassification penalties.

Let me know if you need help determining the correct HS code for a specific product or if you need a customs compliance checklist.

Customer Reviews

Very helpful for someone new to international trade. The HS code section was easy to follow and accurate.

The page gave a good overview of the HS code and tariff rates for plastic doors. Just needed more examples for different countries.

Great resource for understanding the trade regulations for plastic products. Highly recommend for exporters.

The information on the 5% tariff rate was very clear, but I wish there was more about duty exemptions.

I was impressed with how easy it was to find the correct HS code for my product. Saved me a lot of time.