| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

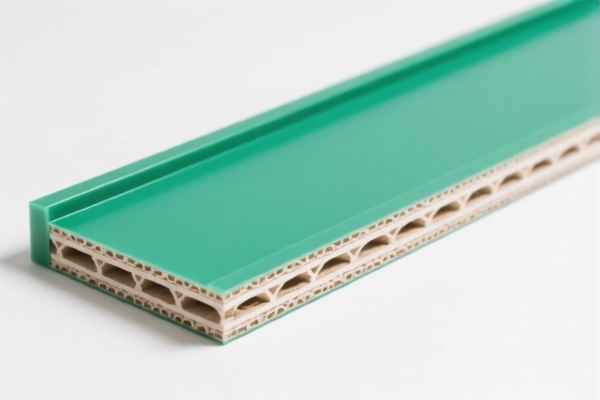

- Product Classification: PVC board

- HS CODE: 3921905050 (as per the provided data)

🔍 Tariff Overview (as of now)

- Base Tariff Rate: 4.8%

- Additional Tariff (currently applicable): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

⚠️ Important Notes on Tariff Changes

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning and customs clearance.

- No Anti-dumping duties are currently listed for this product category (PVC board).

- No specific anti-dumping duties on iron or aluminum apply here, as this is a plastic product.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the PVC board is not reinforced or combined with other materials, as this may affect the HS code classification.

- Check Unit Price and Certification: Confirm whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Monitor Tariff Updates: Keep track of any changes in customs policies, especially the April 11, 2025 tariff increase, to avoid unexpected costs.

- Consult with Customs Broker: For accurate classification and compliance, especially if the product has multiple components or finishes.

📊 Comparison with Other Possible HS Codes

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3921125000 | PVC plastic sheets, other plastics | 61.5% | Higher tax rate, possibly for different specifications |

| 3920995000 | Non-cellular, non-reinforced plastic sheets | 60.8% | May apply to different types of plastic sheets |

| 3916200020 | PVC rods, profiles, etc. | 60.8% | For PVC in rod or profile form |

| 3920431000 | PVC sheets with plasticizers | 58.1% | May apply if the product contains specific additives |

✅ Conclusion

The most appropriate HS code for your PVC board is 3921905050, with a total tax rate of 34.8%. However, be aware that a 30% additional tariff will apply after April 11, 2025, which could significantly increase the import cost. Always confirm the product's exact specifications and consult with a customs expert for compliance.

- Product Classification: PVC board

- HS CODE: 3921905050 (as per the provided data)

🔍 Tariff Overview (as of now)

- Base Tariff Rate: 4.8%

- Additional Tariff (currently applicable): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

⚠️ Important Notes on Tariff Changes

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning and customs clearance.

- No Anti-dumping duties are currently listed for this product category (PVC board).

- No specific anti-dumping duties on iron or aluminum apply here, as this is a plastic product.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the PVC board is not reinforced or combined with other materials, as this may affect the HS code classification.

- Check Unit Price and Certification: Confirm whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Monitor Tariff Updates: Keep track of any changes in customs policies, especially the April 11, 2025 tariff increase, to avoid unexpected costs.

- Consult with Customs Broker: For accurate classification and compliance, especially if the product has multiple components or finishes.

📊 Comparison with Other Possible HS Codes

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3921125000 | PVC plastic sheets, other plastics | 61.5% | Higher tax rate, possibly for different specifications |

| 3920995000 | Non-cellular, non-reinforced plastic sheets | 60.8% | May apply to different types of plastic sheets |

| 3916200020 | PVC rods, profiles, etc. | 60.8% | For PVC in rod or profile form |

| 3920431000 | PVC sheets with plasticizers | 58.1% | May apply if the product contains specific additives |

✅ Conclusion

The most appropriate HS code for your PVC board is 3921905050, with a total tax rate of 34.8%. However, be aware that a 30% additional tariff will apply after April 11, 2025, which could significantly increase the import cost. Always confirm the product's exact specifications and consult with a customs expert for compliance.

Customer Reviews

No reviews yet.