Found 1 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4418911000 | Doc | 55.0% | CN | US | 2025-05-12 |

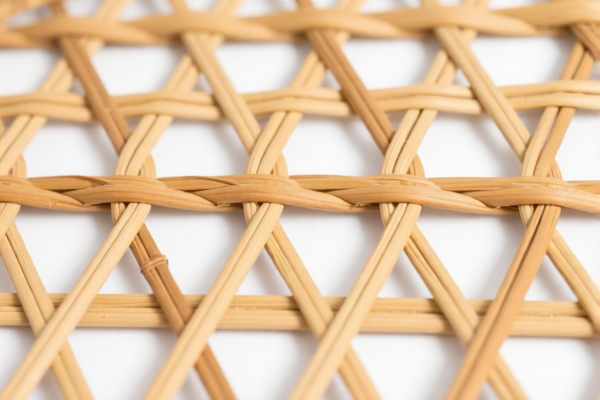

Based on the provided information, classifying "rattan material" requires careful consideration of its specific form and use. Here's a breakdown of potential HS codes, based on the available data, along with explanations:

- 4418.91.10.00: Builders' joinery and carpentry of wood, including cellular wood panels and assembled flooring panels; shingles and shakes: Other: Of bamboo: Drilled or notched lumber studs.

- 44: Wood and articles of wood; wood charcoal. This chapter broadly covers wooden materials.

- 18: Builders’ joinery and carpentry. This specifies construction-related wood products.

- 91: Other. This is a subcategory for items not specifically defined elsewhere within the chapter.

- 10: Of bamboo: Drilled or notched lumber studs. Specifically for bamboo materials.

- Note: While rattan is not bamboo, this code might be applicable if the rattan is processed into lumber studs. Requires confirmation of processing method and intended use.

Important Considerations & Recommendations:

- Material Confirmation: Rattan is a vine, technically not wood. However, it’s often used like wood in construction and furniture. The classification depends on how it's processed and its end use.

- Processing Level: Is the rattan raw, simply dried, or has it been shaped, assembled, or further processed? This significantly impacts the correct HS code.

- Intended Use: Is the rattan for furniture making, construction, handicrafts, or another purpose?

- Tax Rate: The base tariff is 0.0%, with an additional 25.0% tariff. After April 2, 2025, the additional tariff will increase to 30%. The total tariff rate is 55.0%.

Disclaimer: This information is based solely on the limited data provided. Accurate classification requires a complete understanding of the product's characteristics and intended use. Consult with a customs broker or relevant authority for a definitive HS code determination.

Customer Reviews

No reviews yet.