| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8212900000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 8510905500 | Doc | 59.2% | CN | US | 2025-05-12 |

| 8510901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8212100000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 7220208000 | Doc | 30.0% | CN | US | 2025-05-12 |

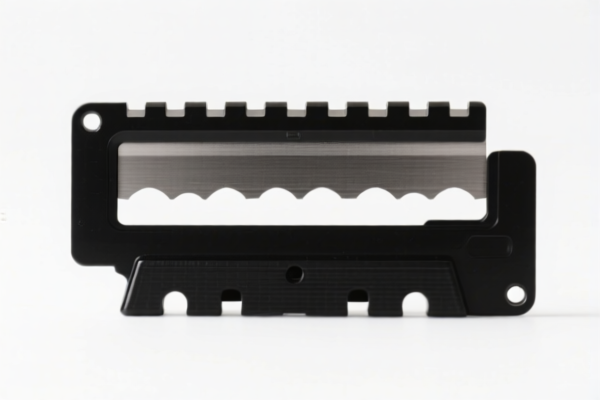

Here is the classification and tariff information for razor blades based on the provided HS codes. Please note that the classification depends on the specific product type, such as whether it is a manual razor blade, electric razor blade, or razor steel sheet.

✅ HS CODE: 8212900000

Product Description:

- Razor blades (including men's, women's, double-edged, single-edged, professional, blade strips, blade cartridges, blade guards, etc.)

Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 7.5%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 37.5% (before April 11, 2025) / 57.5% (after April 11, 2025)

Proactive Advice:

- Confirm whether the product is a razor blade or razor blade cartridge.

- Check if the product is imported as a component or finished product.

✅ HS CODE: 8510905500

Product Description:

- Razor blades (for electric razors)

Tariff Information:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.2% (before April 11, 2025) / 64.2% (after April 11, 2025)

Proactive Advice:

- Ensure the product is specifically for electric razors.

- Verify if the product is sold as a replacement part or included in a razor kit.

✅ HS CODE: 8510901000

Product Description:

- Blades or cutting heads for electric razors

Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 25.0% (before April 11, 2025) / 30.0% (after April 11, 2025)

Proactive Advice:

- Confirm whether the product is a blade or cutting head.

- Check if the product is compatible with specific electric razor models.

✅ HS CODE: 8212100000

Product Description:

- Razors (including disposable razors)

Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 7.5%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 37.5% (before April 11, 2025) / 57.5% (after April 11, 2025)

Proactive Advice:

- Clarify whether the product is a razor or razor blade.

- Confirm if the product is disposable or reusable.

✅ HS CODE: 7220208000

Product Description:

- Razor steel sheets (raw material for razor blades)

Tariff Information:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 30.0% (after April 11, 2025)

Proactive Advice:

- Ensure the product is not finished or not processed into a razor blade.

- Confirm if the product is imported as raw material or for further processing.

📌 Important Notes:

- April 11, 2025 is a critical date for tariff changes.

- Additional tariffs may be applied after this date, significantly increasing the total tax burden.

- Anti-dumping duties may apply to iron and aluminum products, but not directly to razor blades unless they are made from these materials.

- Certifications may be required depending on the product type (e.g., safety, environmental, or product standard certifications).

✅ Action Steps:

- Verify the exact product description (e.g., manual vs. electric, blade vs. razor).

- Check the material composition (e.g., steel, plastic, etc.).

- Confirm the import date to determine the applicable tariff rate.

- Review required certifications for customs clearance.

Let me know if you need help determining the correct HS code for your specific product.

Customer Reviews

No reviews yet.