| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5907008090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5516140085 | Doc | 65.0% | CN | US | 2025-05-12 |

| 5515290045 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5212256020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5907003500 | Doc | 63.0% | CN | US | 2025-05-12 |

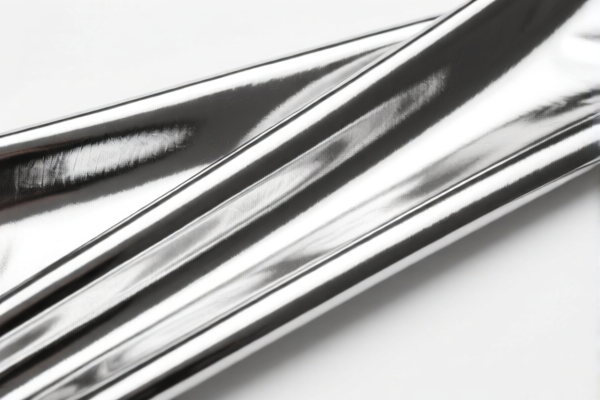

Here is the classification and tariff information for reflective fabric products, based on the provided HS codes and tax details:

✅ HS CODE: 5907008090

Product Name: Reflective Coated Fabric

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code applies to coated fabrics with reflective properties.

- No anti-dumping duties are currently applicable for this product.

- Proactive Advice: Confirm the fabric’s coating type and whether it is woven or non-woven.

✅ HS CODE: 5516140085

Product Name: Printed Reflective Fabric

- Base Tariff Rate: 10.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 65.0%

- Key Notes:

- This code applies to printed reflective fabric, likely made from synthetic fibers.

- Proactive Advice: Verify if the fabric is printed with reflective material or if the print is decorative only.

✅ HS CODE: 5515290045

Product Name: Reflective Oxford Fabric

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code applies to reflective Oxford fabric, typically a type of woven fabric.

- Proactive Advice: Confirm the fabric’s composition and whether it is woven or non-woven.

✅ HS CODE: 5212256020

Product Name: Printed Cotton Reflective Fabric

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code applies to cotton-based reflective fabric with a printed design.

- Proactive Advice: Ensure the fabric is made of cotton and not a blend, and confirm the printing method.

✅ HS CODE: 5907003500

Product Name: Coated Reflective Fabric Material

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 63.0%

- Key Notes:

- This code applies to coated fabric with reflective properties, possibly used in industrial or safety applications.

- Proactive Advice: Confirm the coating material and its purpose (e.g., reflective, waterproof, etc.).

📌 Important Alerts:

- April 11, 2025 Special Tariff: All products listed above will be subject to an additional 30.0% tariff starting from April 11, 2025.

- Anti-dumping duties: Not currently applicable to reflective fabric unless it contains iron or aluminum components (not indicated in the current product descriptions).

- Certifications: Depending on the end-use (e.g., safety gear, industrial), additional certifications may be required (e.g., EN, ANSI, or CE).

🛠️ Proactive Actions for Importers:

- Verify Material Composition: Confirm the fabric’s base material (cotton, polyester, etc.) and coating type.

- Check Unit Price: High unit prices may trigger additional scrutiny or duty calculations.

- Review Certifications: If the fabric is for safety or industrial use, ensure compliance with relevant standards.

- Plan Ahead: With the April 11, 2025 tariff increase, consider adjusting pricing or sourcing strategies early.

Let me know if you need help determining the correct HS code for a specific product or calculating total import costs.

Customer Reviews

No reviews yet.