| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 6210209039 | Doc | 43.7% | CN | US | 2025-05-12 |

| 6211398070 | Doc | 40.3% | CN | US | 2025-05-12 |

| 6211335054 | Doc | 53.5% | CN | US | 2025-05-12 |

| 6211339054 | Doc | 53.5% | CN | US | 2025-05-12 |

| 6210401500 | Doc | 41.3% | CN | US | 2025-05-12 |

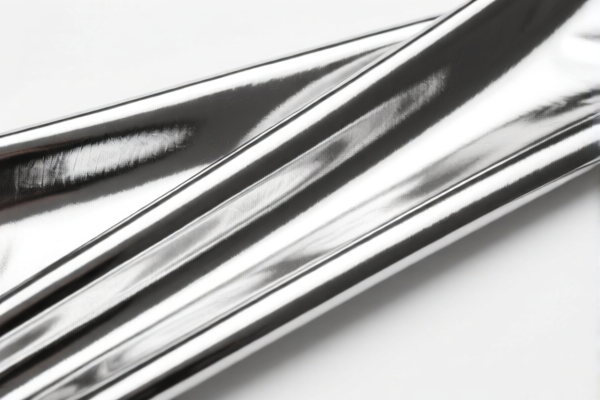

Here is the classification and tariff information for reflective jackets and related products, based on the provided HS codes:

✅ HS CODE: 6210209039

Product: Reflective jackets, reflective raincoats, windbreakers, and similar products

Total Tax Rate: 43.7%

- Base Tariff Rate: 6.2%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general reflective jackets or raincoats, not specifically for vests or sportswear.

✅ HS CODE: 6211398070

Product: Reflective vests for men

Total Tax Rate: 40.3%

- Base Tariff Rate: 2.8%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general men's reflective vests, not for sportswear or high-visibility products.

✅ HS CODE: 6211335054

Product: Reflective sport vests for men

Total Tax Rate: 53.5%

- Base Tariff Rate: 16.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to sportswear-style reflective vests, which are subject to higher base tariffs.

✅ HS CODE: 6211339054

Product: High-visibility reflective vests

Total Tax Rate: 53.5%

- Base Tariff Rate: 16.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for high-visibility vests, often used in safety or work environments, and is subject to the same high base tariff as sportswear.

✅ HS CODE: 6210401500

Product: Reflective vests with rubber coating for men

Total Tax Rate: 41.3%

- Base Tariff Rate: 3.8%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to vests with rubber coating, which may be used in industrial or outdoor settings.

📌 Important Notes and Recommendations:

- Time-Sensitive Policy:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all these products after April 11, 2025. This is a critical date to monitor for cost planning.

-

Anti-Dumping Duties:

-

If the product contains iron or aluminum components, additional anti-dumping duties may apply. Confirm the material composition to avoid unexpected costs.

-

Certifications Required:

-

For high-visibility vests, ensure compliance with EN ISO 20471 or other relevant safety standards, depending on the destination market.

-

Material and Unit Price Verification:

- The material composition (e.g., rubber coating, fabric type) and unit price can significantly affect classification and tax rates. Always verify these details before customs clearance.

🛑 Action Required:

- Confirm the exact product description and material to ensure correct HS code classification.

- Check if certifications (e.g., safety, environmental) are required for import.

- Plan for increased costs due to the April 11, 2025 special tariff.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.