| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 7117907500 | Doc | 30.0% | CN | US | 2025-05-12 |

| 7117905500 | Doc | 44.7% | CN | US | 2025-05-12 |

| 7115906000 | Doc | 59.0% | CN | US | 2025-05-12 |

| 7115903000 | Doc | 58.9% | CN | US | 2025-05-12 |

| 3926400010 | Doc | 35.3% | CN | US | 2025-05-12 |

| 3926909905 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3924905650 | Doc | 40.9% | CN | US | 2025-05-12 |

| 3924902000 | Doc | 33.4% | CN | US | 2025-05-12 |

| 6114909070 | Doc | 35.6% | CN | US | 2025-05-12 |

| 6114909045 | Doc | 35.6% | CN | US | 2025-05-12 |

| 9503000090 | Doc | 30.0% | CN | US | 2025-05-12 |

| 9503000071 | Doc | 30.0% | CN | US | 2025-05-12 |

| 4205008000 | Doc | 55.0% | CN | US | 2025-05-12 |

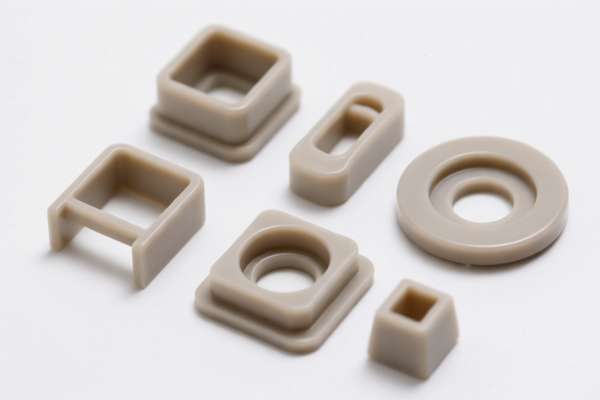

Resin Pendant

A resin pendant is a decorative ornament typically suspended from a necklace, bracelet, or keychain, crafted primarily from resin.

Material

The core material is resin, a viscous liquid that hardens into a solid polymer. Common resin types used in pendants include:

- Epoxy Resin: Most frequently used due to its clarity, durability, and resistance to yellowing. It allows for embedding objects and creating layered effects.

- UV Resin: Cures rapidly under ultraviolet light, making it suitable for smaller projects and quick curing needs. Often used for coating and smaller embellishments.

- Polyester Resin: Less expensive than epoxy, but can be more prone to yellowing and may not be as clear.

- Polyurethane Resin: Offers flexibility and good abrasion resistance, but can be sensitive to moisture.

Purpose

Resin pendants serve primarily as aesthetic accessories. They are utilized for:

- Personal Adornment: Necklaces, earrings, bracelets.

- Keychains and Bag Charms: Decorative additions to personal items.

- Gifts: Customizable and personalized presents.

- Crafting and DIY Projects: Components in larger jewelry designs.

Function

The primary function is decorative. However, resin pendants can also:

- Encapsulate Objects: Preserve flowers, insects, photographs, or other small items.

- Display Art: Showcase miniature paintings or sculpted elements.

- Provide a Protective Layer: Shield embedded objects from external damage.

Usage Scenarios

- Casual Wear: Everyday accessories complementing various outfits.

- Formal Events: Statement pieces adding a unique touch to attire.

- Handmade Markets & Craft Fairs: Sold as individual pieces or part of larger collections.

- Personal Crafting: Created as hobbies or custom designs.

Common Types

- Floral Resin Pendants: Contain preserved dried flowers embedded within the resin.

- Glitter Resin Pendants: Incorporate glitter or mica powders for a sparkling effect.

- Geode Resin Pendants: Mimic the appearance of natural geodes with layered colors and textures.

- Character/Figurine Resin Pendants: Contain miniature characters or sculpted figures.

- Photo Resin Pendants: Encapsulate photographs for personalized keepsakes.

- Clear Resin Pendants: Showcase the natural color of the resin, often used with embedded objects.

- Druzy Resin Pendants: Simulate the appearance of druzy crystals using pigments and powders.

- Ocean Resin Pendants: Recreate the look of ocean waves and marine life within the resin.

Resin pendants fall under various classifications depending on their composition and use. Here's a breakdown of potential HS codes based on the provided reference material:

- 3926400010: This code covers “Other articles of plastics and articles of other materials of headings 3901 to 3914: Statuettes and other ornamental articles Bows and similar products for decorative purposes including gift-packaging and the like”. If the resin pendant is primarily decorative, this could be applicable. The tax rate is 35.3% (5.3% basic tariff + 0.0% additional tariff, increasing to 30.0% additional tariff after 2025.4.2).

- 7117907500: This code covers “Imitation jewelry: Other: Other: Valued over 20 cents per dozen pieces or parts: Other: Of plastics”. If the pendant is considered imitation jewelry made of plastic and valued over 20 cents per dozen, this code applies. The total tax rate is 30.0% (0.0% basic tariff + 0.0% additional tariff, increasing to 30.0% additional tariff after 2025.4.2).

- 9503000090: This code covers “Tricycles, scooters, pedal cars and similar wheeled toys; dollsʼ carriages; dolls, other toys; reduced-scale (“scaleˮ) models and similar recreational models, working or not; puzzles of all kinds; parts and accessories thereof Other”. If the resin pendant is considered a toy or recreational item, this code might be relevant. The total tax rate is 30.0% (0.0% basic tariff + 0.0% additional tariff, increasing to 30.0% additional tariff after 2025.4.2).

Important Considerations:

The classification of resin pendants can be complex. If the pendant contains precious metals or is designed as jewelry, HS code 7117907500 may be more appropriate. If it's a decorative item, HS code 3926400010 could apply. If it's intended for children, HS code 9503000090 should be considered.

Customer Reviews

No reviews yet.