| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9025198085 | Doc | 55.0% | CN | US | 2025-05-12 |

| 9025114000 | Doc | 30.0% | CN | US | 2025-05-12 |

| 9025112000 | Doc | 30.0% | CN | US | 2025-05-12 |

| 9030333400 | Doc | 56.7% | CN | US | 2025-05-12 |

| 8533290000 | Doc | 55.0% | CN | US | 2025-05-12 |

Here is the classification and tariff information for the resistance thermometer based on the provided HS codes and details:

✅ HS CODE: 9025198085

Product Name: High-precision platinum resistance thermometer

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to high-precision platinum resistance thermometers, which are typically used in industrial or scientific applications.

- The high total tax rate is due to the combination of the additional and special tariffs.

- Proactive Advice: Confirm the exact material (e.g., platinum) and whether it's used for scientific or industrial purposes, as this may affect classification.

✅ HS CODE: 9025114000

Product Name: Electronic thermometer

Total Tax Rate: 30.0%

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for general-purpose electronic thermometers, not high-precision or platinum-based.

- The tax rate is entirely due to the special tariff after April 11, 2025.

- Proactive Advice: Ensure the product is not classified under a more specific code (e.g., 9025198085) if it is high-precision.

✅ HS CODE: 9025112000

Product Name: Thermometer

Total Tax Rate: 30.0%

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is a general classification for non-electronic, non-high-precision thermometers.

- The tax rate is entirely due to the special tariff after April 11, 2025.

- Proactive Advice: Verify if the thermometer is electronic or high-precision, as this may change the applicable code.

✅ HS CODE: 9030333400

Product Name: Resistance meter

Total Tax Rate: 56.7%

Tariff Breakdown:

- Base Tariff Rate: 1.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to instruments used for measuring resistance, which may be related but not the same as a resistance thermometer.

- The high tax rate is due to the combination of base, additional, and special tariffs.

- Proactive Advice: Confirm whether the product is a measuring instrument or a thermometer, as this can significantly affect classification.

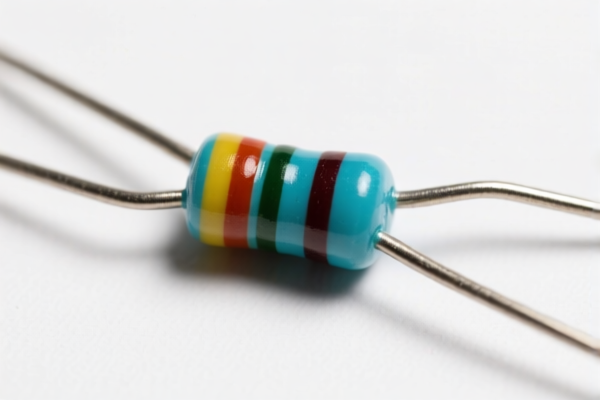

✅ HS CODE: 8533290000

Product Name: Current detection resistor

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for resistors used in current detection, which are not thermometers but may be part of a thermometer system.

- The tax rate is due to the combination of additional and special tariffs.

- Proactive Advice: Ensure the product is not misclassified as a thermometer if it is not used for temperature measurement.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All listed products are subject to an additional 30.0% tariff after this date.

- Certifications: Depending on the product, certifications such as CE, RoHS, or calibration certificates may be required for customs clearance.

- Material Verification: Confirm the exact composition and function of the product to avoid misclassification and potential penalties.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

The page provided a good overview of HS codes for resistance thermometers. The detailed breakdown of each tariff rate made it easy to understand the costs involved.

The HS code 8533290000 for current detection resistors was explained clearly. The note about avoiding misclassification was very helpful for someone new to this field.

The page had good info, but I found it confusing to tell the difference between a resistance meter and a thermometer. Maybe adding a comparison table would help.

The details on the 55% tax rate for high-precision platinum resistance thermometers were spot on. It clarified why the rate was higher and what factors influence it.

The HS code 9030333400 for resistance meters was well-explained. The note about not confusing it with a thermometer was really useful and saved me from a possible mistake.