| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8482105064 | Doc | 64.0% | CN | US | 2025-05-12 |

| 8482105036 | Doc | 64.0% | CN | US | 2025-05-12 |

| 8482105044 | Doc | 64.0% | CN | US | 2025-05-12 |

| 8482105048 | Doc | 64.0% | CN | US | 2025-05-12 |

| 8482993500 | Doc | 64.9% | CN | US | 2025-05-12 |

Here is the classification and tariff information for roller bearings based on the provided HS codes:

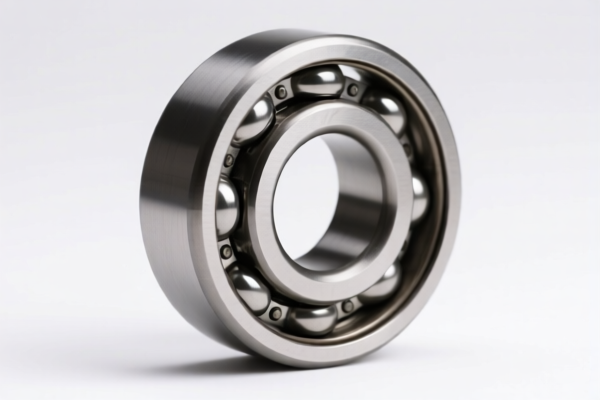

✅ HS CODE: 8482105064

Product Description: Steel ball bearings (roller bearings)

Total Tax Rate: 64.0%

Tariff Breakdown:

- Base Tariff Rate: 9.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 8482105036

Product Description: Roller bearings (ball bearings)

Total Tax Rate: 64.0%

Tariff Breakdown:

- Base Tariff Rate: 9.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 8482105044

Product Description: Single-row ball bearings, with outer diameter ≥9mm and ≤30mm

Total Tax Rate: 64.0%

Tariff Breakdown:

- Base Tariff Rate: 9.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 8482105048

Product Description: Single-row ball bearings, with outer diameter between 30mm and 52mm

Total Tax Rate: 64.0%

Tariff Breakdown:

- Base Tariff Rate: 9.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 8482993500

Product Description: Ball bearings components, including those with integral shafts

Total Tax Rate: 64.9%

Tariff Breakdown:

- Base Tariff Rate: 9.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Time-sensitive Tariff:

- Starting April 11, 2025, an additional 30.0% tariff will be applied to all these HS codes.

-

This is a critical date for customs clearance planning and cost estimation.

-

Material and Certification:

- Verify the material (e.g., steel, aluminum, etc.) and unit price to ensure correct classification.

-

Check if any certifications (e.g., ISO, RoHS, etc.) are required for import compliance.

-

Anti-dumping Duties:

- Be aware that anti-dumping duties may apply to iron and aluminum products, depending on the origin and trade policies.

-

Confirm the country of origin to determine if such duties are applicable.

-

Classification Accuracy:

- The HS code depends on the type, size, and material of the bearing.

- For example, bearings with different outer diameters fall under different HS codes (e.g., 8482105044 vs. 8482105048).

🛑 Action Required:

- Double-check the HS code based on the exact product specifications (e.g., size, material, type).

- Consult a customs broker or import compliance expert if the product is close to the boundary of multiple classifications.

- Plan ahead for the April 11, 2025 tariff increase to avoid unexpected costs.

Let me know if you need help determining the correct HS code for your specific product.

Customer Reviews

No reviews yet.