| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 6808000000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6810195000 | Doc | 58.9% | CN | US | 2025-05-12 |

| 6810990080 | Doc | 55.0% | CN | US | 2025-05-12 |

| 7016905000 | Doc | 60.0% | CN | US | 2025-05-12 |

| 7016901050 | Doc | 63.0% | CN | US | 2025-05-12 |

| 7610900020 | Doc | 85.7% | CN | US | 2025-05-12 |

| 7610900040 | Doc | 85.7% | CN | US | 2025-05-12 |

| 9406900190 | Doc | 82.9% | CN | US | 2025-05-12 |

| 9406900130 | Doc | 82.9% | CN | US | 2025-05-12 |

| 7604291090 | Doc | 35.0% | CN | US | 2025-05-12 |

| 7604295090 | Doc | 33.0% | CN | US | 2025-05-12 |

| 8308909000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 8306300000 | Doc | 82.7% | CN | US | 2025-05-12 |

| 8306100000 | Doc | 35.8% | CN | US | 2025-05-12 |

| 3926903000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3925100000 | Doc | 61.3% | CN | US | 2025-05-12 |

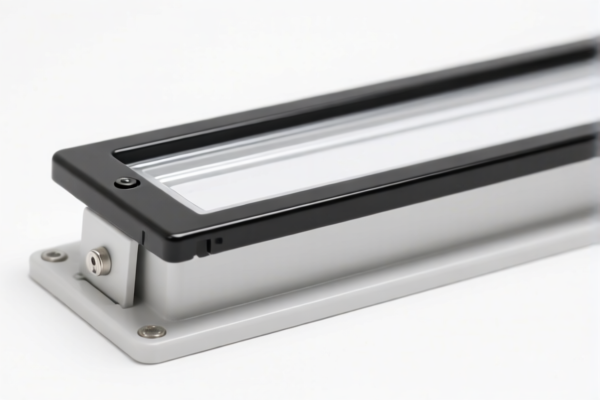

Roof Light Retainer

A roof light retainer, also known as a roof vent retainer or skylight retainer, is a component used to secure a roof light (skylight or vent) to a vehicle roof. It prevents the light from dislodging during transit or in adverse weather conditions.

Material:

- Plastic: Most commonly constructed from durable plastics like ABS or Polypropylene due to their lightweight nature and resistance to weathering.

- Metal: Some heavy-duty applications, or for older vehicle models, may utilize metal retainers, often stainless steel or coated steel for corrosion resistance.

Purpose:

The primary purpose is safety and security. Without a functioning retainer, the roof light could be blown open while driving, creating significant noise, drag, and potential for damage to the vehicle or surrounding traffic. They also help maintain the weather sealing of the roof light.

Function:

Retainers typically function using a clamping mechanism. This can involve:

- Spring-loaded clips: These grip onto the roof light frame and the vehicle roof edge.

- Screw-down clamps: These tighten around the frame and roof, providing a more secure hold.

- Rotating latches: These lock the light in place with a twisting motion.

- Combination systems: Some retainers utilize a blend of these mechanisms.

Usage Scenarios:

- Vehicles with pop-up roofs: Common in campervans, recreational vehicles (RVs), and some commercial vehicles.

- Vehicles with aftermarket skylights: Installed for additional light and ventilation.

- Replacement parts: Used to repair or replace damaged retainers.

- Vehicles with factory-installed skylights: As original equipment or replacement components.

Common Types:

- Side-Mount Retainers: Attach to the sides of the roof light frame and clamp to the roof. These are very common.

- Corner Retainers: Secure the corners of the roof light, often used in conjunction with side-mount retainers.

- Full Perimeter Retainers: A continuous retainer that wraps around the entire roof light opening, providing maximum security.

- Adjustable Retainers: Allow for varying roof thicknesses or slight frame imperfections.

- Specific Vehicle/Skylight Models: Many retainers are designed for particular vehicle makes and models or specific skylight brands. Compatibility is crucial.

Based on the provided information, “roof light retainer” can be classified under the following HS codes:

- 3925900000 - Builders' ware of plastics, not elsewhere specified or included: Other. This code covers plastic builders' ware not specifically mentioned elsewhere. Given that a roof light retainer functions as a component in building construction, this is a potential classification. The total tax rate is 60.3%.

- 3926903000 - Other articles of plastics and articles of other materials of headings 3901 to 3914: Other: Parts for yachts or pleasure boats of heading 8903; parts of canoes, racing shells, pneumatic craft and pleasure boats which are not of a type designed to be principally used with motors or sails. While not a direct match, if the roof light retainer is used in the construction of pleasure boats, this code could apply. The total tax rate is 59.2%.

- 7610900020 - Aluminum structures (excluding prefabricated buildings of heading 9406) and parts of structures (for example, bridges and bridge-sections, towers, lattice masts, roofs, roofing frameworks, doors and windows and their frames and thresholds for doors, balustrades, pillars and columns); aluminum plates, rods, profiles, tubes and the like, prepared for use in structures: Other Sheet-metal roofing, siding, flooring, and roof guttering and drainage equipment. If the retainer is made of aluminum and functions as part of a roofing system, this code is applicable. The total tax rate is 85.7%.

- 8308909000 - Clasps, frames with clasps, buckles, buckle-clasps, hooks, eyes, eyelets and the like, of base metal, of a kind used for clothing or clothing accessories, footwear, jewelry, wrist watches, books, awnings, leather goods, travel goods or saddlery or for other made up articles; tubular or bifurcated rivets, of base metal; beads and spangles, of base metal: Other, including parts: Other. If the retainer is a metal clasp or frame used to secure the roof light, this code may be relevant. The total tax rate is 57.7%.

Regarding HS code 7610900020, please note that the description specifically includes sheet-metal roofing, siding, and flooring. If the retainer is made of aluminum and is part of a roofing system, this code is applicable.

Customer Reviews

No reviews yet.