| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4005990000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4016996050 | Doc | 57.5% | CN | US | 2025-05-12 |

| 4016990500 | Doc | 40.9% | CN | US | 2025-05-12 |

| 4016935010 | Doc | 57.5% | CN | US | 2025-05-12 |

| 4005910000 | Doc | 55.0% | CN | US | 2025-05-12 |

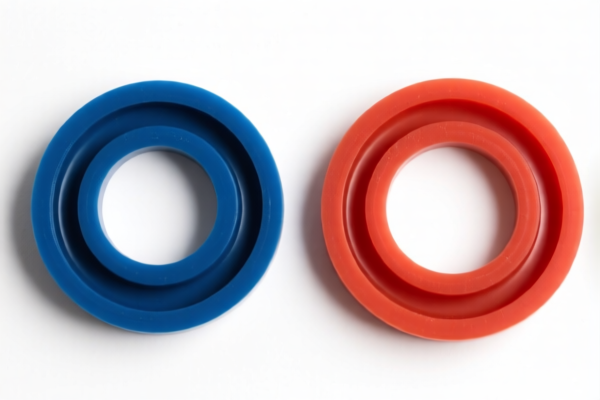

Here is the classification and tariff information for rubber seals based on the provided HS codes. This information is critical for customs compliance and cost estimation.

🔍 HS Code Classification for Rubber Seals

1. HS Code: 4005990000

Description: Unvulcanized compound rubber, in sheets, strips, or blocks, suitable for rubber seals.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- Applicable to unvulcanized rubber used in seals.

- No anti-dumping duties apply.

- Proactive Advice: Confirm whether the rubber is vulcanized or not, as this determines the correct HS code.

2. HS Code: 4016990500

Description: Other vulcanized rubber articles (excluding hard rubber), suitable for rubber seals used in household items.

- Base Tariff Rate: 3.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 40.9%

- Key Notes:

- Applicable to vulcanized rubber seals used in household items.

- Proactive Advice: Ensure the product is not classified under "hard rubber" (HS Code 401610), which may have different rates.

3. HS Code: 4016935010

Description: Other vulcanized rubber articles, such as gaskets, washers, and seals, including O-rings.

- Base Tariff Rate: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.5%

- Key Notes:

- Specifically for seals and gaskets like O-rings.

- Proactive Advice: Verify the exact product type (e.g., O-ring, gasket) to ensure correct classification.

4. HS Code: 4005910000

Description: Unvulcanized compound rubber, suitable for rubber seals.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- Similar to 4005990000, but may be used for specific types of rubber seals.

- Proactive Advice: Confirm the material composition and intended use to avoid misclassification.

5. HS Code: 4016935050

Description: Other vulcanized rubber articles, such as gaskets, nut washers, and other seals.

- Base Tariff Rate: 2.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.5%

- Key Notes:

- Covers seals and gaskets used in industrial or mechanical applications.

- Proactive Advice: Check if the product is custom-made or standard, as this may affect classification.

⚠️ Important Alerts:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all listed HS codes after April 11, 2025.

- Anti-dumping duties: Not currently applicable to rubber seals, but always verify with the latest customs updates.

- Certifications: Ensure compliance with import certifications (e.g., RoHS, REACH) if applicable.

✅ Action Checklist:

- ✅ Confirm whether the rubber is vulcanized or unvulcanized.

- ✅ Identify the specific type of seal (e.g., O-ring, gasket, washer).

- ✅ Check if the product is custom-made or standard.

- ✅ Verify material composition and unit price for accurate tax calculation.

- ✅ Review certifications required for import into the destination country.

Let me know if you need help determining the correct HS code for your specific product.

Customer Reviews

The breakdown of the 4005990000 HS code and the 55.0% total rate was very clear. I especially liked the advice on checking if the rubber is vulcanized or not.

The 4016935050 HS code with the 57.5% tariff was exactly what I needed for my industrial seals. The note about standard vs. custom-made products was really helpful.

The info on 4016935010 was useful, but I found it a bit confusing to determine whether my product falls under gaskets or seals. Still, the details were good.

The 30.0% special tariff after April 11, 2025 was crucial for my budgeting. The clear explanation of the 55.0% total tax rate for 4005990000 was very helpful.

The detailed explanation of the 4005910000 HS code with the 55.0% rate was spot on for my unvulcanized rubber seals. The advice on material composition was a great tip.