| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8708295160 | Doc | 2.5% <u></u>+105.0% | CN | US | 2025-05-12 |

| 3923900080 | Doc | 58.0% | CN | US | 2025-05-12 |

| 8418998050 | Doc | 105.0% | CN | US | 2025-05-12 |

| 4008115000 | Doc | 58.3% | CN | US | 2025-05-12 |

| 4016935050 | Doc | 57.5% | CN | US | 2025-05-12 |

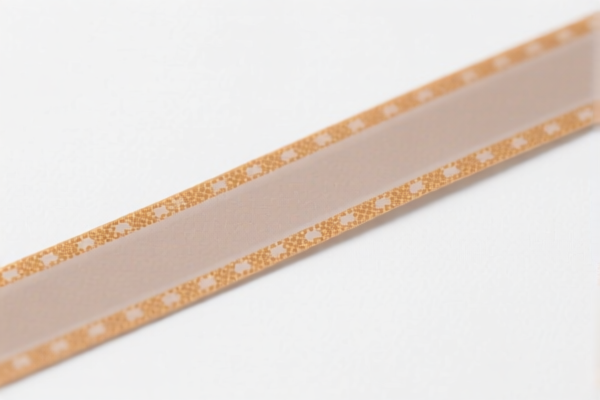

Here is the structured classification and tariff information for seal strips based on the provided HS codes and tariff details:

✅ HS CODE: 8708295160

Product Classification: Seal strips used as parts or accessories for automotive bodies.

Tariff Summary:

- Base Tariff Rate: 2.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Steel/Aluminum Products Additional Tariff: 50%

Key Notes:

- This classification applies to seal strips used in automotive applications.

- The total effective tariff rate is 2.5% + 25.0% = 27.5%, and after April 11, 2025, it increases to 30.0%.

- If the seal strip contains steel or aluminum, an additional 50% tariff will be applied.

Proactive Advice:

- Confirm the material composition of the seal strip (e.g., rubber, plastic, or metal).

- Check if the product is intended for automotive use to ensure correct classification.

✅ HS CODE: 3923900080

Product Classification: Plastic seal strips classified under packaging materials.

Tariff Summary:

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This classification applies to plastic seal strips used as packaging materials.

- The total effective tariff rate is 3.0% + 25.0% = 28.0%, and after April 11, 2025, it increases to 30.0%.

Proactive Advice:

- Ensure the seal strip is made of plastic and used for packaging purposes.

- Verify the unit price and material composition for accurate tariff calculation.

✅ HS CODE: 8418998050

Product Classification: Seal strips used as parts of refrigerators or cooling equipment.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Steel/Aluminum Products Additional Tariff: 50%

Key Notes:

- This classification applies to seal strips used in refrigerators or cooling equipment.

- The total effective tariff rate is 0.0% + 25.0% = 25.0%, and after April 11, 2025, it increases to 30.0%.

- If the seal strip contains steel or aluminum, an additional 50% tariff will be applied.

Proactive Advice:

- Confirm the intended use of the seal strip (e.g., for refrigerators or cooling equipment).

- Check if the product is imported as a component or finished product.

✅ HS CODE: 4008115000

Product Classification: Rubber seal strips made of vulcanized rubber.

Tariff Summary:

- Base Tariff Rate: 3.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This classification applies to rubber seal strips made of vulcanized rubber.

- The total effective tariff rate is 3.3% + 25.0% = 28.3%, and after April 11, 2025, it increases to 30.0%.

Proactive Advice:

- Ensure the seal strip is made of vulcanized rubber.

- Confirm the intended use (e.g., automotive, industrial, or household).

✅ HS CODE: 4016935050

Product Classification: Rubber seal strips classified as gaskets or seals.

Tariff Summary:

- Base Tariff Rate: 2.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This classification applies to rubber seal strips used as gaskets or seals.

- The total effective tariff rate is 2.5% + 25.0% = 27.5%, and after April 11, 2025, it increases to 30.0%.

Proactive Advice:

- Confirm the material (e.g., rubber) and function (e.g., sealing, gasketing).

- Check if any certifications are required for import (e.g., RoHS, REACH).

📌 Important Reminder:

- April 11, 2025 is a critical date for tariff changes.

- If your product contains steel or aluminum, be prepared for additional tariffs.

- Always verify the material, use, and classification to avoid misclassification and customs delays.

Customer Reviews

No reviews yet.