Found 6 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4814900200 | Doc | 37.5% | CN | US | 2025-05-12 |

| 6810191400 | Doc | 64.0% | CN | US | 2025-05-12 |

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

| 4821902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3919905030 | Doc | 60.8% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for self-adhesive products based on the provided HS codes. Please note that the April 11, 2025 tariff adjustment applies to all products listed below.

✅ HS CODE: 4814900200 – Self-adhesive wallpaper

- Product Type: Paper products

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 37.5%

- Key Notes:

- This classification applies to self-adhesive wallpaper made of paper.

- Verify the material (must be paper-based) and unit price for accurate classification.

- No anti-dumping duties apply to this category.

✅ HS CODE: 6810191400 – Self-adhesive floor tiles

- Product Type: Cement, concrete, or artificial stone products

- Base Tariff Rate: 9.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 64.0%

- Key Notes:

- This classification applies to self-adhesive floor tiles made of cement, concrete, or artificial stone.

- Check the composition (must be cement/concrete-based).

- Anti-dumping duties may apply depending on the origin and material.

✅ HS CODE: 3919905010 – Self-adhesive reflective tape

- Product Type: Plastic self-adhesive products (e.g., reflective tape)

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 60.8%

- Key Notes:

- This classification applies to self-adhesive reflective tape or similar plastic products.

- Verify the material (must be plastic-based).

- Anti-dumping duties may apply depending on the origin and material.

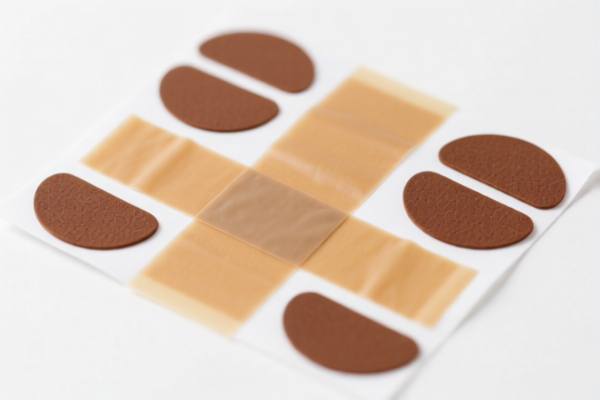

✅ HS CODE: 3919905060 – Self-adhesive transparent tape, stickers, etc.

- Product Type: Plastic self-adhesive products (e.g., stickers, waterproof tape, decorative films)

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 60.8%

- Key Notes:

- This classification covers a wide range of plastic self-adhesive products, including stickers, waterproof tape, and decorative films.

- Verify the product type and material (must be plastic-based).

- Anti-dumping duties may apply depending on the origin and material.

✅ HS CODE: 4821902000 – Self-adhesive product labels

- Product Type: Paper and cardboard labels

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This classification applies to self-adhesive paper or cardboard labels.

- Verify the material (must be paper-based).

- No anti-dumping duties apply to this category.

✅ HS CODE: 3919905030 – Self-adhesive tape strips

- Product Type: Electrically insulating adhesive tape

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 60.8%

- Key Notes:

- This classification applies to self-adhesive tape strips used for electrical insulation.

- Verify the function and material (must be plastic-based and electrically insulating).

- Anti-dumping duties may apply depending on the origin and material.

📌 Proactive Advice for Importers:

- Verify the product composition and material to ensure correct HS code classification.

- Check the unit price and certifications required (e.g., RoHS, REACH, or other compliance standards).

- Be aware of the April 11, 2025 tariff increase (30.0%) for most products.

- Review anti-dumping duties if the product is made of iron, aluminum, or plastic and imported from certain countries.

- Consult a customs broker or compliance expert for complex or high-value shipments.

Let me know if you need help determining the correct HS code for a specific product.

Customer Reviews

No reviews yet.