| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9405416000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 8530900000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8608000000 | Doc | 58.8% | CN | US | 2025-05-12 |

| 8531200020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8608000000 | Doc | 58.8% | CN | US | 2025-05-12 |

Here is the classification and tariff information for the signal light products you declared, with a focus on HS codes, tax rates, and relevant customs compliance considerations:

✅ Product Classification & Tariff Overview

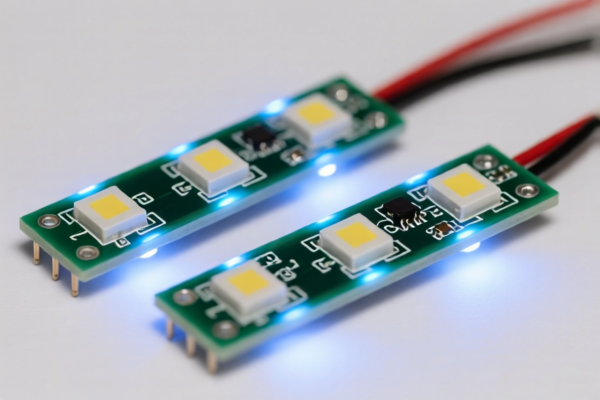

1. LED Signal Light

HS CODE: 9405416000

- Base Tariff Rate: 6.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

⚠️ Note: This product is subject to the April 11 Special Tariff and additional tariffs. Ensure you are aware of the exact import date to calculate the correct tax.

2. Railway Signal Light

HS CODE: 8530900000

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Note: Although the base rate is 0%, the additional and special tariffs still apply. This product is not subject to anti-dumping duties on iron or aluminum.

3. Signal Light Bracket

HS CODE: 8608000000

- Base Tariff Rate: 3.8%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.8%

⚠️ Note: This product is subject to anti-dumping duties if it contains iron or aluminum components. Verify the material composition before import.

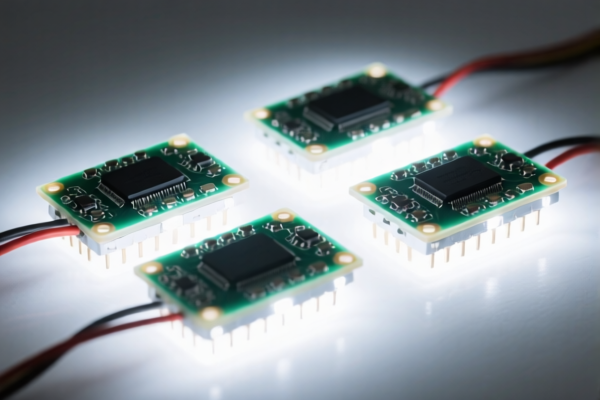

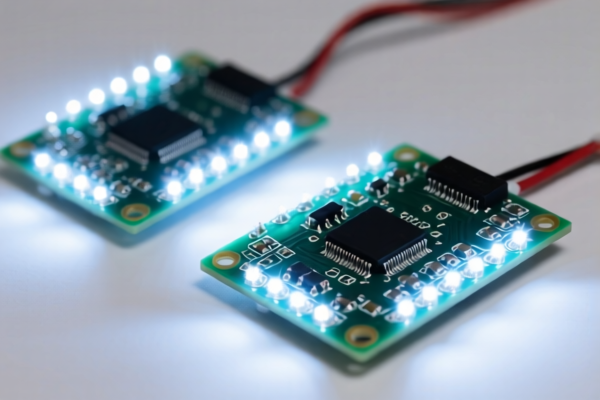

4. LED Signal Indicator Light

HS CODE: 8531200020

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Note: Similar to the railway signal light, this product is not subject to anti-dumping duties on iron or aluminum.

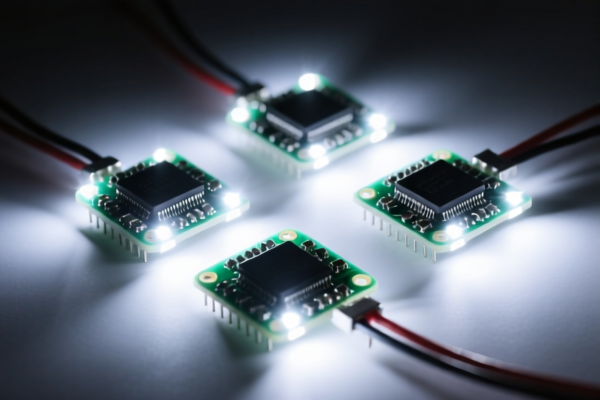

5. Port Signal Light

HS CODE: 8608000000

- Base Tariff Rate: 3.8%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.8%

⚠️ Note: This product is subject to anti-dumping duties if it contains iron or aluminum components. Verify the material composition before import.

📌 Proactive Compliance Advice

- Verify Material Composition: If your product contains iron or aluminum, it may be subject to anti-dumping duties. Confirm the exact materials used.

- Check Unit Price: The total tax rate is calculated based on the unit price and HS code. Ensure accurate classification.

- Certifications Required: Some signal lights may require safety certifications (e.g., CE, UL, or RoHS) depending on the destination market.

- Import Date: Be mindful of the April 11, 2025 deadline for special tariffs. This could significantly impact your total tax liability.

Let me know if you need help determining the correct HS code for your specific product or assistance with customs documentation.

Customer Reviews

The HS code and tariff information for signal light brackets was accurate, but I would have liked a bit more detail on how to verify the material composition for anti-dumping duties.

The breakdown of the total tax rate for HS code 9405416000 was very clear. I especially appreciated the note about the April 11 special tariff and how it affects the total rate.

This site gave me all the details I needed on the LED signal indicator light with HS code 8531200020. The 55% tariff rate and note on no anti-dumping duties were clear and helpful.

The port signal light information was good, but I found the images a bit unclear. Still, the HS code 8608000000 and tax details were exactly what I needed.

I needed to export signal light brackets and found the HS code 8608000000 with the total tax rate of 58.8% very useful. The note on anti-dumping duties was a lifesaver.