| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8482101040 | Doc | 57.4% | CN | US | 2025-05-12 |

| 8482990500 | Doc | 64.9% | CN | US | 2025-05-12 |

| 7326908688 | Doc | 82.9% | CN | US | 2025-05-12 |

| 7326908688 | Doc | 82.9% | CN | US | 2025-05-12 |

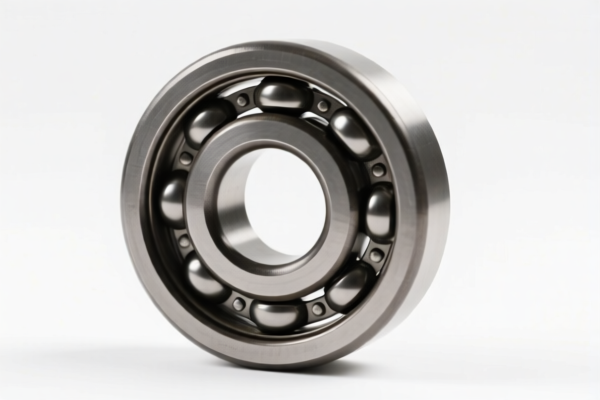

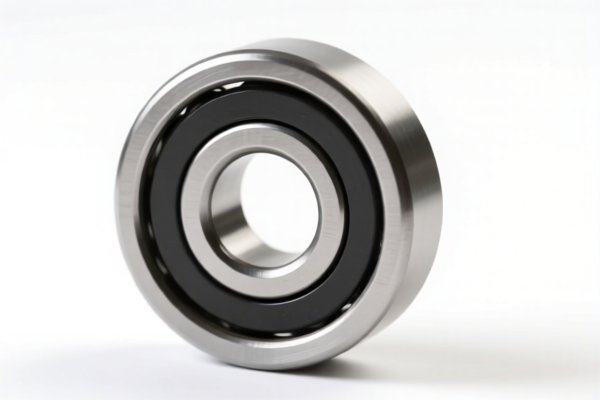

Small Bearing

A small bearing is a type of bearing that is characterized by its compact size, typically with an outer diameter of less than 26mm (1 inch). These bearings are utilized in applications where space is limited and high precision, low friction, and smooth operation are required.

Material

Small bearings are commonly manufactured from:

- Steel: Most frequently used due to its high load capacity, durability, and cost-effectiveness. Common steel alloys include chrome steel (SAE 52100) and stainless steel (e.g., 304, 440C).

- Ceramic: Often silicon nitride (Si₃N₄) or zirconia (ZrO₂). Ceramic bearings offer superior corrosion resistance, higher speed capabilities, and non-magnetic properties. They are suitable for harsh environments and high-temperature applications.

- Plastic: Polymer bearings (e.g., nylon, acetal) are lightweight, self-lubricating, and corrosion-resistant, making them ideal for low-load applications.

Purpose

The primary purpose of a small bearing is to reduce friction between moving parts, enabling smooth rotational or linear motion. They support loads, maintain alignment, and transmit power efficiently.

Function

Small bearings function by utilizing rolling elements (balls or rollers) between the inner and outer races. These rolling elements minimize the contact area and friction between the moving surfaces. The cage (also known as a retainer) separates the rolling elements and ensures proper spacing.

Usage Scenarios

Small bearings are found in a diverse range of applications, including:

- Electronics: Hard drives, optical drives, CD/DVD players, printers, scanners.

- Robotics: Joints, actuators, and gearboxes.

- Medical Devices: Surgical instruments, dental drills, and pumps.

- Automotive: Alternators, starters, and fuel pumps.

- Toys & Hobbies: Model cars, drones, and fishing reels.

- Industrial Machinery: Miniature gearboxes, precision instruments, and small motors.

Common Types

- Deep Groove Ball Bearings: The most common type, suitable for radial and axial loads.

- Angular Contact Ball Bearings: Designed to handle combined radial and axial loads in one direction.

- Thrust Ball Bearings: Specifically designed for axial loads.

- Needle Bearings: Utilize cylindrical rollers for high radial load capacity in a small space.

- Miniature Ball Bearings: Extremely small bearings, often used in precision instruments and electronics.

- Flange Bearings: Incorporate a flange for easy mounting.

- Hybrid Bearings: Combine ceramic rolling elements with steel races, offering a balance of performance and cost.

Based on the provided information, “small bearing” can be classified under the following HS codes:

-

8482101040: This HS code covers Ball or roller bearings, and parts thereof: Ball bearings: Ball bearings with integral shafts Bearings having an outside diameter not over 30 mm. This is specifically for ball bearings with shafts integrated and a diameter of 30mm or less. The basic tariff is 2.4%, with an additional tariff of 25.0%. After April 2, 2025, the additional tariff increases to 30%, resulting in a total tariff of 57.4%.

-

8482990500: This HS code covers Ball or roller bearings, and parts thereof: Parts: Other: Inner or outer rings or races: For ball bearings. This applies to parts of ball bearings, specifically inner or outer rings/races. The basic tariff is 9.9%, with an additional tariff of 25.0%. After April 2, 2025, the additional tariff increases to 30%, resulting in a total tariff of 64.9%.

-

7326908688: This HS code covers Other articles of iron or steel: Other: Other: Other: Other. This is a broader category for other iron or steel articles. The basic tariff is 2.9%, with an additional tariff of 25.0%. After April 2, 2025, the additional tariff increases to 30% for steel and aluminum products, resulting in a total tariff of 82.9%.

-

7326908688: This HS code covers Other articles of iron or steel: Other: Other: Other: Other Other. This is a broader category for other iron or steel articles. The basic tariff is 2.9%, with an additional tariff of 25.0%. After April 2, 2025, the additional tariff increases to 30% for steel and aluminum products, resulting in a total tariff of 82.9%.

According to the provided reference material, the HS code options related to 'small bearing' are limited, with only the following 4 found.

Regarding HS code 7326908688, please note the additional tariff of 25% applies to steel and aluminum products, increasing to 30% after April 2, 2025.

Customer Reviews

No reviews yet.