| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8448330000 | Doc | 40.8% | CN | US | 2025-05-12 |

| 8448595000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 8445400000 | Doc | 41.2% | CN | US | 2025-05-12 |

| 8445900000 | Doc | 41.2% | CN | US | 2025-05-12 |

| 8544110020 | Doc | 58.5% | CN | US | 2025-05-12 |

| 8544110030 | Doc | 58.5% | CN | US | 2025-05-12 |

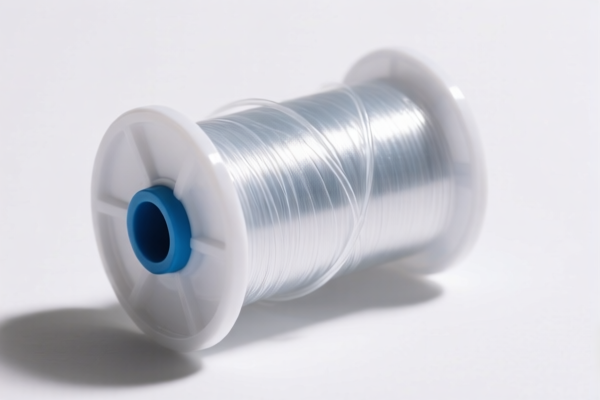

Spool

A spool is a cylindrical device around which thread, wire, rope, twine, or film is wound. It serves as a convenient and organized way to store and dispense these materials. Spools are ubiquitous in a variety of applications, from textile manufacturing and sewing to electronics and industrial processes.

Material

Spools are constructed from a diverse range of materials, selected based on the intended application and the material being wound upon them. Common materials include:

- Wood: Historically, wood was the primary material for spools. It remains popular for certain applications, particularly in crafting and decorative uses, and for winding heavier threads.

- Plastic: Most modern spools are made from plastic (often polypropylene or nylon) due to its lower cost, durability, and ability to be molded into complex shapes.

- Metal: Metal spools (aluminum, steel) are used for heavier materials like wire, cable, and in industrial applications requiring high strength and resistance to deformation.

- Cardboard/Paper: Lightweight and disposable spools are frequently made from cardboard or paper, often used for temporary storage or in low-stress applications.

Purpose

The core purpose of a spool is to:

- Store: Provide a compact and organized method for holding thread, wire, or other linear materials.

- Dispense: Allow for controlled and even release of the material as it is needed.

- Transport: Facilitate the easy movement of these materials.

- Protect: Shield the material from damage, tangling, and environmental factors.

Function

The function of a spool relies on its cylindrical shape and the winding process. The material is layered around the core of the spool, creating a reservoir that can be unwound as required. The shape minimizes friction and allows for smooth release, and the core provides structural integrity. Some spools incorporate features like flanges (raised edges) to prevent the material from slipping off the sides.

Usage Scenarios

Spools are found in a wide variety of applications:

- Sewing & Textiles: Holding sewing thread for both manual and machine sewing.

- Knitting & Crochet: Containing yarn for handcrafting.

- Electronics: Winding wire for components, transformers, and motors.

- Industrial Applications: Storing and dispensing cables, ropes, and other linear materials in construction, manufacturing, and packaging.

- Fishing: Holding fishing line.

- 3D Printing: Filament is typically wound on spools for use in FDM printers.

- Data Storage (historical): Magnetic tape was wound on spools for early computer data storage.

Common Types

- Sewing Machine Spools: Typically plastic, with a specific shape to fit the sewing machine bobbin winder.

- Yarn Spools: Often cardboard or plastic, available in various sizes and weights.

- Wire Spools: Made from metal or plastic, designed to hold heavier gauge wire.

- Flanged Spools: Feature raised edges to prevent material slippage.

- Cord Spools: Plastic or wood, used for extension cords and other similar applications.

- Pre-Wound Spools: Spools that come with the material already wound onto them, ready for immediate use.

- Empty Spools: Used for winding materials manually.

Based on the provided information, “spool” can be associated with several HS codes, depending on its material and function. Here's a breakdown of relevant codes:

-

8448330000: This code covers auxiliary machinery for use with machines of heading 8444, 8445, 8446 or 8447, specifically parts and accessories of machines of heading 8445 or of their auxiliary machinery: Spindles, spindle flyers, spinning rings and ring travellers. A spool used in conjunction with spinning machines (heading 8445) would fall under this classification.

- Chapter 84: Machines, mechanical appliances, electrical equipment, and their parts.

- Heading 8448: Auxiliary machinery for use with machines of heading 8444, 8445, 8446 or 8447; parts and accessories suitable for use solely or principally with the machines of this heading or of heading 8444, 8445, 8446 or 8447.

- Subheading 8448330000: Specifically covers parts and accessories of machines of heading 8445 or of their auxiliary machinery: Spindles, spindle flyers, spinning rings and ring travellers.

- Tax Rate: Base tariff: 3.3%, Additional tariff: 7.5%, Post-April 2, 2025, additional tariff: 30%. Total tariff: 40.8%.

-

8544110020: This code covers insulated (including enameled or anodized) wire, cable (including coaxial cable) and other insulated electric conductors, whether or not fitted with connectors; optical fiber cables, made up of individually sheathed fibers, whether or not assembled with electric conductors or fitted with connectors: Winding wire: Of copper 33 AWG (0.18 mm in diameter) and finer. If the spool is made of copper winding wire with a diameter of 33 AWG or finer, this code applies.

- Chapter 85: Electrical machinery and equipment.

- Heading 8544: Insulated (including enameled or anodized) wire, cable (including coaxial cable) and other insulated electric conductors.

- Subheading 8544110020: Specifically covers winding wire of copper 33 AWG (0.18 mm in diameter) and finer.

- Tax Rate: Base tariff: 3.5%, Additional tariff: 25.0%, Post-April 2, 2025, additional tariff: 30%. Total tariff: 58.5%.

-

8544110030: This code covers insulated (including enameled or anodized) wire, cable (including coaxial cable) and other insulated electric conductors, whether or not fitted with connectors; optical fiber cables, made up of individually sheathed fibers, whether or not assembled with electric conductors or fitted with connectors: Winding wire: Of copper 22 AWG (0.643 mm in diameter) and finer but larger than 33 AWG (0.18 mm in diameter). If the spool is made of copper winding wire with a diameter between 22 AWG (0.643 mm) and 33 AWG (0.18 mm), this code applies.

- Chapter 85: Electrical machinery and equipment.

- Heading 8544: Insulated (including enameled or anodized) wire, cable (including coaxial cable) and other insulated electric conductors.

- Subheading 8544110030: Specifically covers winding wire of copper 22 AWG (0.643 mm in diameter) and finer but larger than 33 AWG (0.18 mm in diameter).

- Tax Rate: Base tariff: 3.5%, Additional tariff: 25.0%, Post-April 2, 2025, additional tariff: 30%. Total tariff: 58.5%.

Customer Reviews

No reviews yet.