| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8482910010 | Doc | 59.4% | CN | US | 2025-05-12 |

| 7326110000 | Doc | 105.0% | CN | US | 2025-05-12 |

| 8482910070 | Doc | 59.4% | CN | US | 2025-05-12 |

| 7323999080 | Doc | 108.4% | CN | US | 2025-05-12 |

| 8481809010 | Doc | 57.0% | CN | US | 2025-05-12 |

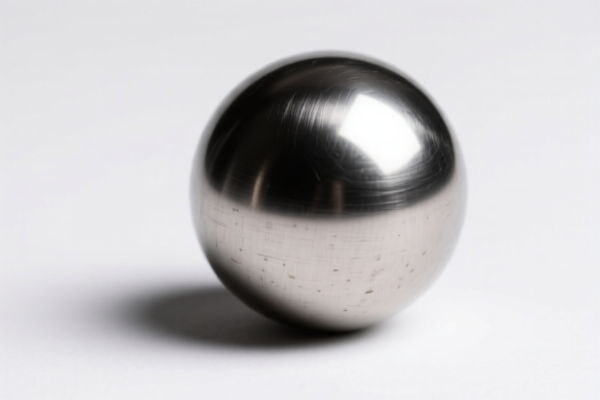

Here is the classification and tariff information for stainless steel balls, based on the provided HS codes and tariff details:

✅ HS CODE: 8482910010

Product Description: Stainless steel bearing balls (classified under "bearings and parts thereof", specifically alloy steel balls)

- Base Tariff Rate: 4.4%

- Additional Tariff (after April 2, 2025): 30.0%

- Total Tariff Rate (after April 2, 2025): 34.4%

- Special Notes:

- This code applies to bearing steel balls used in bearings.

- No anti-dumping duties currently apply to this category.

- Proactive Advice: Confirm the product is used for bearings and not for general industrial purposes.

✅ HS CODE: 7326110000

Product Description: Non-magnetic steel balls (classified under "other iron or steel articles", specifically forged or stamped grinding balls for mills)

- Base Tariff Rate: 0.0%

- Additional Tariff (after April 2, 2025): 30.0%

- Steel/Aluminum Additional Tariff (after April 2, 2025): 50.0%

- Total Tariff Rate (after April 2, 2025): 80.0% (if subject to steel/aluminum additional tariffs)

- Special Notes:

- This code applies to grinding balls used in industrial mills.

- High additional tariffs apply to steel and aluminum products.

- Proactive Advice: Verify if the steel balls are used for grinding purposes and check for any anti-dumping or countervailing duties.

✅ HS CODE: 8482910070

Product Description: Stainless steel spherical rollers (classified under "ball bearings or roller bearings and parts thereof", specifically spherical rollers)

- Base Tariff Rate: 4.4%

- Additional Tariff (after April 2, 2025): 30.0%

- Total Tariff Rate (after April 2, 2025): 34.4%

- Special Notes:

- This code applies to spherical rollers used in roller bearings.

- No anti-dumping duties currently apply.

- Proactive Advice: Ensure the product is used in bearings and not for general purposes.

✅ HS CODE: 7323999080

Product Description: Stainless steel wire balls (classified under "other steel articles", specifically wire balls)

- Base Tariff Rate: 3.4%

- Additional Tariff (after April 2, 2025): 30.0%

- Steel/Aluminum Additional Tariff (after April 2, 2025): 50.0%

- Total Tariff Rate (after April 2, 2025): 83.4% (if subject to steel/aluminum additional tariffs)

- Special Notes:

- This code applies to wire balls, which may be used in abrasive or cleaning applications.

- High additional tariffs apply to steel and aluminum products.

- Proactive Advice: Confirm the product's intended use and check for any anti-dumping or countervailing duties.

✅ HS CODE: 8481809010

Product Description: Stainless steel ball valves (classified under "valves and parts thereof")

- Base Tariff Rate: 2.0%

- Additional Tariff (after April 2, 2025): 30.0%

- Total Tariff Rate (after April 2, 2025): 32.0%

- Special Notes:

- This code applies to ball valves used in piping systems.

- No anti-dumping duties currently apply.

- Proactive Advice: Ensure the product is classified as a valve and not a general steel ball.

📌 Key Takeaways:

- April 2, 2025 is a critical date for tariff changes.

- Steel and aluminum products face higher additional tariffs (up to 50%) after this date.

- Verify the product's exact use (e.g., bearing, valve, grinding ball) to ensure correct classification.

- Check for certifications (e.g., material composition, origin) to avoid delays in customs clearance.

- Consult a customs broker if the product is used in sensitive industries (e.g., aerospace, automotive) to avoid unexpected duties.

Let me know if you need help determining the correct HS code for your specific stainless steel ball product.

Customer Reviews

I needed to confirm the HS code for spherical rollers, and 8482910070 was exactly what I was looking for. The tariff breakdown was straightforward and very useful for my export planning.

The breakdown of each HS code, including the additional tariffs, was exactly what I needed for my business. The site made it easy to understand complex trade information.

I was looking for HS Code details on stainless steel ball valves, and the explanation for 8481809010 was spot on. The 32% tariff rate was clearly explained, which helped me plan my export costs.

The section on 7323999080 was a bit confusing at first. I had to verify the product description multiple times to be sure it matched my wire balls, but the site did provide the necessary info.

I found the HS Code 7326110000 for non-magnetic steel balls and was impressed by the explanation of the high additional tariffs. This helped me avoid unexpected costs.