Found 11 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 7321906060 | Doc | 80.0% | CN | US | 2025-05-12 |

| 7321906090 | Doc | 80.0% | CN | US | 2025-05-12 |

| 7326908688 | Doc | 82.9% | CN | US | 2025-05-12 |

| 7326908605 | Doc | 82.9% | CN | US | 2025-05-12 |

| 3926903000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3925100000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 6815994170 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6815992000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6810195000 | Doc | 58.9% | CN | US | 2025-05-12 |

| 6810990080 | Doc | 55.0% | CN | US | 2025-05-12 |

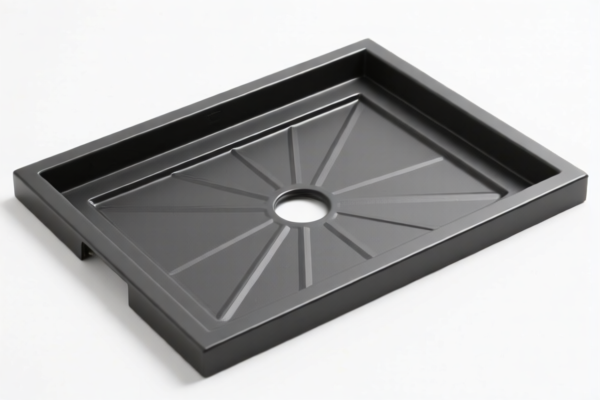

Stove Gap Covers - HS Code Classification

Based on the provided information, classifying "stove gap covers" requires careful consideration of material and intended use. Here's a breakdown of potential HS codes, along with explanations:

- 7321.90.60: Stoves, ranges, grates, cookers… Parts: Other Of cooking appliances and plate warmers: Other - This code is suitable if the covers are specifically designed and sold as parts for stoves, ranges, or cookers. The first two digits (73) indicate articles of iron or steel. The next two (21) specify stoves, ranges, and similar. The final digits indicate parts and accessories.

- 7321.90.90: Stoves, ranges, grates, cookers… Parts: Other Other - Similar to the above, this is for parts of cooking appliances. It's a broader category within parts.

- 3926.90.30: Other articles of plastics and articles of other materials… Parts for yachts or pleasure boats… - If the covers are made of plastic and are designed for use in yachts or pleasure boats, this code might apply. (39 indicates plastics).

- 3925.90.00: Builders' ware of plastics, not elsewhere specified or included: Other - If the covers are made of plastic and are considered builders' ware (e.g., used in kitchen installation), this could be a relevant code.

- 6815.99.4170: Articles of stone or of other mineral substances… Other articles: Other: Other Other - If the covers are made of stone or other mineral substances, this code applies. (68 indicates stone and other mineral substances).

Important Considerations:

- Material: The primary material (iron/steel, plastic, stone, etc.) is crucial for accurate classification.

- Intended Use: Are the covers specifically designed for stoves, or are they general-purpose items?

- Certification: Depending on the material and intended use, certain certifications (e.g., safety standards for kitchen appliances) may be required.

- Single Invoice: If the covers are sold together with stoves, the HS code may differ.

Recommendation:

Please provide the material composition and detailed product description for a more accurate HS code determination. It is also recommended to consult with a customs broker or relevant authority to ensure compliance with all applicable regulations.

Customer Reviews

No reviews yet.