| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9017800000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 9031909195 | Doc | 80.0% | CN | US | 2025-05-12 |

| 9031905900 | Doc | 55.0% | CN | US | 2025-05-12 |

| 7326908688 | Doc | 82.9% | CN | US | 2025-05-12 |

| 7326903500 | Doc | 87.8% | CN | US | 2025-05-12 |

| 7323997000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 7323999080 | Doc | 83.4% | CN | US | 2025-05-12 |

Test Tube Clamp

A test tube clamp is a laboratory instrument used to securely hold a test tube or other similar glassware. They are commonly used in chemistry, biology, and other scientific disciplines where heating, mixing, or other manipulation of test tube contents is required.

Material:

- Stainless Steel: The most common material due to its resistance to corrosion and high temperatures.

- Carbon Steel (with coating): Less expensive but prone to rust if not properly maintained. Often coated with rubber or plastic for better grip and protection.

- Plastic: Used for lower-temperature applications or when metal clamps might interfere with the experiment.

Purpose:

The primary purpose is to provide a stable and safe grip on test tubes, allowing for manipulation without direct handling, which can be dangerous due to heat or chemical hazards. They enable controlled heating, mixing, and pouring.

Function:

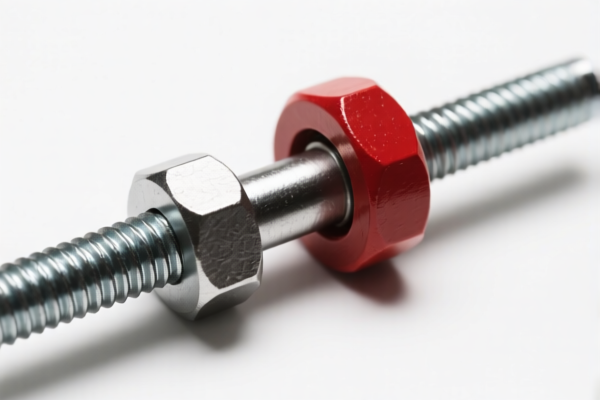

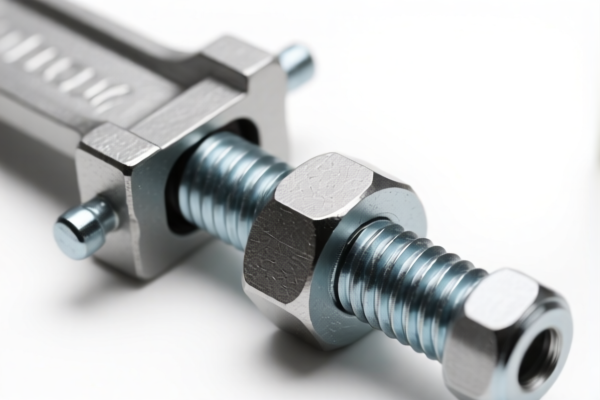

Test tube clamps function through a spring-loaded jaw mechanism. The jaws are tightened onto the test tube using an adjustable screw. The design provides a firm hold without cracking the glass. Many clamps incorporate a rubber or plastic coating on the jaws to improve grip and protect the glass surface.

Usage Scenarios:

- Heating: Holding test tubes over a Bunsen burner or hot plate.

- Titration: Securing a test tube during titration experiments.

- Mixing: Holding a test tube while stirring its contents.

- Pouring: Providing a controlled grip during liquid transfer.

- Holding during Reactions: Maintaining a test tube's position during chemical reactions.

Common Types:

- Spring Clamp: The most basic type, utilizing a spring to apply pressure.

- Screw Clamp: Offers more precise control over clamping force via an adjustable screw. Generally considered more secure.

- Double Spring Clamp: Provides enhanced grip and stability.

- Beaker Clamp: Similar in design but with wider jaws to accommodate beakers. (Though often used interchangeably, beaker clamps are not ideal for test tubes).

- Utility Clamp: A versatile clamp that can hold various sizes of glassware.

Safety Considerations:

- Proper Sizing: Use a clamp appropriate for the size of the test tube.

- Avoid Over-Tightening: Excessive force can crack the glass.

- Regular Inspection: Check for rust or damage before use.

- Heat Resistance: Ensure the clamp material can withstand the temperature of the application.

- Never clamp a hot test tube directly: Allow the tube to cool slightly before clamping.

Based on the material, use, and application scenarios, a test tube clamp is a laboratory instrument used to hold test tubes. Here are the relevant HS codes found within the provided reference material:

-

9017.80.00.00: This HS code falls under Chapter 90, which covers “Instruments and apparatus which measure, check, test, navigate or otherwise control the functioning of, or are used in conjunction with, instruments or apparatus of headings 9023 to 9032. Other instruments.” Specifically, it covers “Other instruments.” The tax rate details indicate a base tariff of 5.3%, an additional tariff of 25.0%, and an additional tariff of 30.0% after April 2, 2025, resulting in a total tariff of 60.3%.

-

7326.90.86.88: This HS code falls under Chapter 73, which covers “Articles of iron or steel.” More specifically, it covers “Other articles of iron or steel,” then “Other,” then “Other,” then “Other,” then “Other Other.” The tax rate details indicate a base tariff of 2.9%, an additional tariff of 25.0%, and an additional tariff of 30.0% after April 2, 2025, with a 25% additional tariff for steel and aluminum products, resulting in a total tariff of 82.9%.

Regarding HS code 7326.90.86.88, please note the need to verify the material (steel or aluminum) and may require additional tariff consideration.

Customer Reviews

No reviews yet.