| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 6907224000 | Doc | 63.5% | CN | US | 2025-05-12 |

| 6907211005 | Doc | 65.0% | CN | US | 2025-05-12 |

| 6907219051 | Doc | 63.5% | CN | US | 2025-05-12 |

| 6907211011 | Doc | 65.0% | CN | US | 2025-05-12 |

| 6907401011 | Doc | 65.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for tiles based on the provided HS codes:

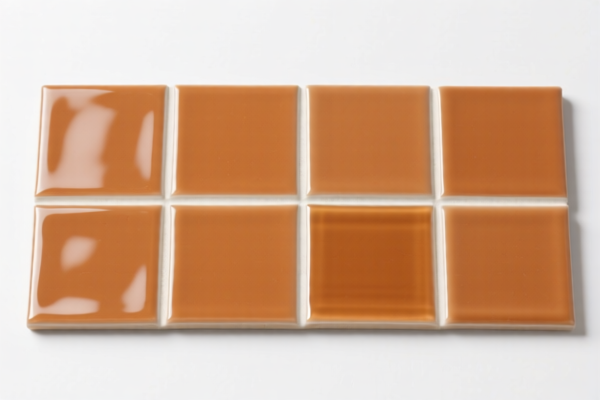

✅ Product Classification Overview: Tiles

Tiles are classified under various HS codes depending on their type, surface treatment, and water absorption rate. Below are the key classifications and associated tariffs:

📌 HS CODE: 6907219051

Description:

- Ceramic tiles, paving stones, floor tiles, wall tiles, etc.

- General classification for tiles not covered by more specific codes.

Tariff Details:

- Base Tariff Rate: 8.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 63.5%

📌 HS CODE: 6907211011

Description:

- Unglazed ceramic floor tiles, paving stones, wall tiles, etc.

- Water absorption rate ≤ 0.5%.

Tariff Details:

- Base Tariff Rate: 10.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 65.0%

📌 HS CODE: 6907224000

Description:

- Ceramic tiles, including floor tiles, wall tiles, and paving stones.

Tariff Details:

- Base Tariff Rate: 8.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 63.5%

📌 HS CODE: 6907211005

Description:

- Unglazed ceramic floor tiles, wall tiles, and paving stones.

Tariff Details:

- Base Tariff Rate: 10.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 65.0%

📌 HS CODE: 6907401011

Description:

- Unglazed ceramic facing tiles (e.g., wall tiles, decorative tiles).

Tariff Details:

- Base Tariff Rate: 10.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 65.0%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all tiles after April 11, 2025, regardless of the base rate. This is a time-sensitive policy and must be accounted for in cost calculations. -

Anti-dumping duties:

If the tiles are made of iron or aluminum, additional anti-dumping duties may apply. These are not included in the above rates and must be verified separately.

📌 Proactive Advice for Importers:

-

Verify Material and Unit Price:

Confirm the material composition (e.g., ceramic, porcelain, glazed or unglazed) and unit price to ensure correct classification. -

Check Required Certifications:

Some tiles may require certifications (e.g., CE, ISO, or environmental compliance) depending on the destination country. -

Consult a Customs Broker:

For complex classifications or high-value shipments, consult a customs broker or compliance expert to avoid delays or penalties.

Let me know if you need help determining the correct HS code for your specific tile product.

Customer Reviews

No reviews yet.