| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9506400000 | Doc | 35.1% | CN | US | 2025-05-12 |

| 9506910030 | Doc | 42.1% | CN | US | 2025-05-12 |

| 9503000090 | Doc | 30.0% | CN | US | 2025-05-12 |

| 9503000071 | Doc | 30.0% | CN | US | 2025-05-12 |

| 4016910000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 4008210000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4008294000 | Doc | 57.9% | CN | US | 2025-05-12 |

| 6815910011 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6815910071 | Doc | 55.0% | CN | US | 2025-05-12 |

| 2508700000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 2508400150 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6806900090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6811899000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6811820000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3926903000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3926909910 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 6304996040 | Doc | 33.2% | CN | US | 2025-05-12 |

| 6304920000 | Doc | 36.3% | CN | US | 2025-05-12 |

| 6306905000 | Doc | 34.5% | CN | US | 2025-05-12 |

| 6306901000 | Doc | 33.5% | CN | US | 2025-05-12 |

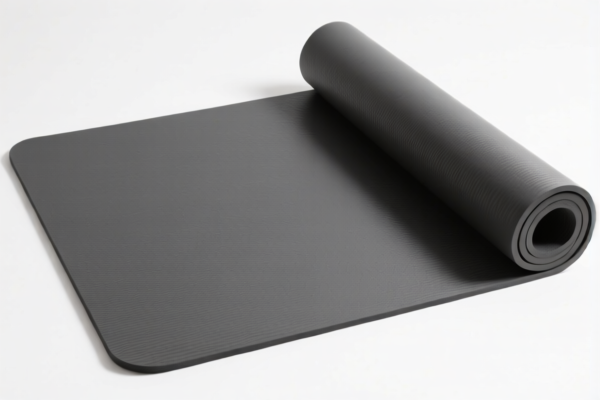

Training Mat for Swing

A training mat for swing is a protective and functional ground covering designed for use with golf swings, baseball swings, or similar athletic movements. These mats aim to provide a realistic impact surface, protect floors and equipment, and often aid in swing analysis.

Material:

- Synthetic Rubber: The most common material, offering durability, consistent impact feel, and weather resistance. Variations include SBR rubber (Styrene-Butadiene Rubber) and EPDM rubber (Ethylene Propylene Diene Monomer).

- Polypropylene: A lighter, more affordable option, often used for indoor practice. Less durable than rubber.

- Turf: Some mats incorporate artificial turf to mimic the feel of real grass, providing a more authentic practice experience.

- Combination: Many mats utilize a layered construction, combining rubber for impact absorption with turf for a realistic hitting surface.

Purpose:

- Impact Absorption: Protects floors, concrete, or other surfaces from damage caused by repeated impacts from golf clubs or bats.

- Realistic Feel: Provides a surface that closely simulates the feel of hitting real turf or ground, allowing for more accurate practice swings.

- Swing Analysis: Certain mats incorporate markings or technology to aid in swing analysis, such as alignment guides or sensors for tracking swing path.

- Noise Reduction: Dampens the sound of impact, making practice more comfortable in indoor environments.

Function:

The primary function is to provide a stable, safe, and consistent surface for practicing swings. Mats absorb energy from the impact, reducing stress on the club/bat and the floor. Advanced mats can also provide visual cues for proper alignment and swing mechanics.

Usage Scenarios:

- Home Practice: Ideal for indoor or outdoor practice in a garage, basement, or backyard.

- Golf Driving Ranges: Used extensively in driving range bays to provide a consistent hitting surface for customers.

- Training Facilities: Utilized in golf academies and training centers for lessons and practice sessions.

- Sports Complexes: Found in batting cages and other sports facilities.

Common Types:

- Golf Mats: Specifically designed for golf swings, often with a teeing ground and markings for alignment. Subtypes include:

- Stationary Mats: Remain fixed in place.

- Portable Mats: Can be easily moved and rolled up for storage.

- Commercial Grade Mats: More durable and designed for high-volume use.

- Baseball/Softball Mats: Larger and more robust to withstand the impact of baseball/softball bats.

- Multi-Sport Mats: Designed to accommodate a variety of sports swings.

- Alignment Mats: Feature markings to guide proper stance and swing path.

- Sensor Mats: Incorporate sensors to track swing speed, path, and other data.

Based on the provided information, the declared goods "training mat for swing" can be classified under the following HS codes:

- 4016910000: This HS code covers “Other articles of vulcanized rubber other than hard rubber: Other: Floor coverings and mats”. This is applicable if the mat is made of vulcanized rubber. The total tax rate is 57.7%.

- 3918901000: This HS code covers “Floor coverings of plastics, whether or not self-adhesive, in rolls or in the form of tiles; wall or ceiling coverings of plastics, as defined in note 9 to this chapter: Of other plastics: Floor coverings”. This is applicable if the mat is made of plastics. The total tax rate is 60.3%.

- 6306905000: This HS code covers “Tarpaulins, awnings and sunblinds; tents (including temporary canopies and similar articles); sails for boats, sailboards or landcraft; camping goods: Other: Of other textile materials”. This is applicable if the mat is made of other textile materials. The total tax rate is 34.5%.

Explanation of HS Code Structure (based on provided reference material):

The HS code is a standardized system used to classify traded products. It consists of six digits, with each section providing more specific information about the product.

- Chapter (First two digits): Indicates the broad category of the product. For example, Chapter 40 covers “Rubber and articles thereof”, Chapter 39 covers “Plastics and articles thereof”, and Chapter 63 covers “Other textile articles”.

- Heading (Next two digits): Further defines the product within the chapter. For example, Heading 4016 covers “Other articles of vulcanized rubber other than hard rubber”, Heading 3918 covers “Floor coverings of plastics”, and Heading 6306 covers “Tarpaulins, awnings and sunblinds”.

- Subheading (Last two digits): Provides the most specific classification of the product. For example, 4016910000 specifically refers to “Floor coverings and mats” made of vulcanized rubber.

Proactive Suggestions:

Regarding HS code 4016910000, please note that the product is classified as “Floor coverings and mats” made of vulcanized rubber.

Regarding HS code 3918901000, please note that the product is classified as “Floor coverings” made of plastics.

Regarding HS code 6306905000, please note that the product is classified as “Floor coverings” made of other textile materials.

Customer Reviews

No reviews yet.