| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4009110000 | Doc | 57.5% | CN | US | 2025-05-12 |

| 4009110000 | Doc | 57.5% | CN | US | 2025-05-12 |

| 4006100000 | Doc | 40.4% | CN | US | 2025-05-12 |

| 4006901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3917320020 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3926905000 | Doc | 41.3% | CN | US | 2025-05-12 |

| 3926909987 | Doc | 42.8% | CN | US | 2025-05-12 |

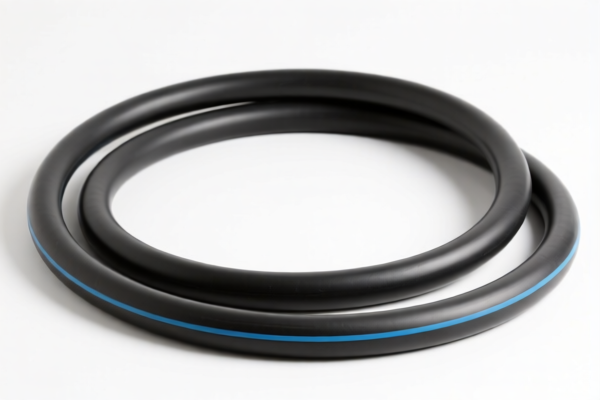

Water Hose - HS Code Classification

Here's a breakdown of potential HS codes for "water hose," based on typical materials and applications. Please note that the exact HS code depends on the hose's composition, reinforcement, and intended use.

-

3917.40.00 - Flexible hoses of plastics: This covers hoses made entirely of plastic.

- 39: Plastics and articles thereof.

- 17: Gutters, pipes and hoses.

- 40: Flexible hoses.

- 00: Other. (This is a broad category; specifics within this code depend on the plastic type – PVC, polyethylene, etc.)

- Note: This is common for garden hoses or lighter-duty water transfer applications.

-

4009.30.00 - Rubber hoses with metal reinforcement: If the hose incorporates metal braiding or wire for strength.

- 40: Rubber and articles thereof.

- 09: Hoses, tubing and similar flexible products of rubber.

- 30: Reinforced hoses.

- 00: Other.

- Example: Hoses used in automotive cooling systems or industrial applications.

-

4009.40.00 - Rubber hoses without metal reinforcement: For rubber hoses that are not reinforced with metal.

- 40: Rubber and articles thereof.

- 09: Hoses, tubing and similar flexible products of rubber.

- 40: Other hoses.

- 00: Other.

- Example: Simple rubber water hoses for domestic use.

-

6109.10.00 - Textile hoses and tubing: If the hose is primarily constructed from textile materials (e.g., braided fabric).

- 61: Textiles articles, woven fabrics.

- 09: Other textile articles.

- 10: Other hoses and tubing.

- 00: Other.

-

7307.90.00 - Iron or steel tubes and pipes, other: If the hose is made of iron or steel with a protective coating.

- 73: Iron or steel products.

- 07: Tubes and pipes.

- 90: Other.

- 00: Other.

-

7608.20.00 - Aluminium tubes and pipes: If the hose is made of aluminum.

- 76: Aluminum and articles thereof.

- 08: Tubes and pipes.

- 20: Other.

- 00: Other.

-

8436.10.00 - Valves and other pipe fittings: If the hose is part of a larger valve or fitting assembly.

- 84: Nuclear reactors, boilers, machinery and mechanical appliances.

- 36: Valves and other pipe fittings.

- 10: Other.

- 00: Other.

-

3707.90.00 - Other products of chemical industry: If the hose is made of special chemical materials.

- 37: Organic chemicals

- 07: Other.

- 90: Other.

- 00: Other.

-

6210.40.00 - Other textile articles: If the hose is a complex textile product with specific finishing.

- 62: Textile articles, not woven fabrics.

- 10: Other textile articles.

- 40: Other.

- 00: Other.

Important Considerations:

- Material Composition: The primary material (plastic, rubber, metal, textile) is the biggest determining factor.

- Reinforcement: Does the hose have metal braiding or wire?

- Application: Is it for garden use, industrial applications, automotive, etc.?

- Single or Multiple Layers: The structure of the hose impacts the classification.

- Relevant Certifications: Depending on the application (e.g., drinking water), specific certifications might be required. Please check the import regulations of your destination country.

- Accurate Declaration: It is crucial to provide a detailed description of the hose to customs authorities. Incorrect classification can lead to delays and penalties.

- Confirm with Customs: Always verify the final HS code with the customs authority in the importing country.

Customer Reviews

No reviews yet.