| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8423100030 | Doc | 30.0% | CN | US | 2025-05-12 |

| 8423810040 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8423891000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8423899000 | Doc | 57.9% | CN | US | 2025-05-12 |

| 8423899000 | Doc | 57.9% | CN | US | 2025-05-12 |

Here is the classification and tariff information for the weighing scale products you provided, with a clear breakdown of the HS codes and applicable tariffs:

🔍 Product Classification & Tariff Overview

1. Electronic Human Body Scale

HS CODE: 8423100030

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 30.0%

- Notes:

- This product is classified under a general category of electronic scales used for body weight.

- The April 11 Special Tariff applies directly to this product.

- Proactive Advice: Confirm the product is not classified under a more specific code (e.g., medical equipment) which may have different regulations.

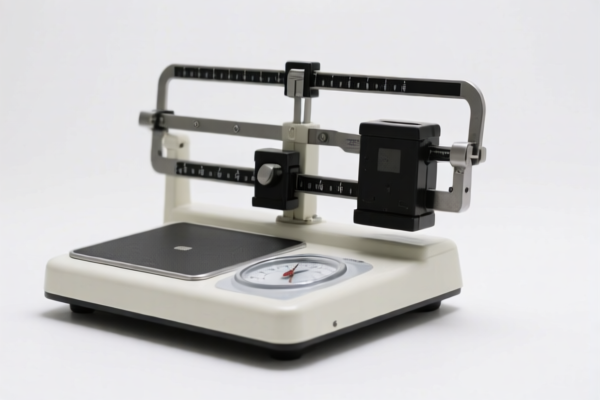

2. Laboratory Electronic Scale

HS CODE: 8423810040

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This is a specialized scale used in laboratories, likely with higher precision.

- The April 11 Special Tariff increases the rate from 25% to 30%.

- Proactive Advice: Verify if the scale is used for scientific research or industrial purposes, as this may affect classification.

3. Electronic Counting Scale

HS CODE: 8423891000

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This scale is used for counting items (e.g., in manufacturing or logistics).

- The April 11 Special Tariff increases the rate from 25% to 30%.

- Proactive Advice: Ensure the product is not classified under a different category (e.g., industrial equipment).

4. Electronic Platform Scale

HS CODE: 8423899000

- Base Tariff Rate: 2.9%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 57.9%

- Notes:

- This is a general-purpose platform scale, possibly used in warehouses or industrial settings.

- The April 11 Special Tariff increases the rate from 25% to 30%.

- Proactive Advice: Confirm the exact use and specifications to avoid misclassification.

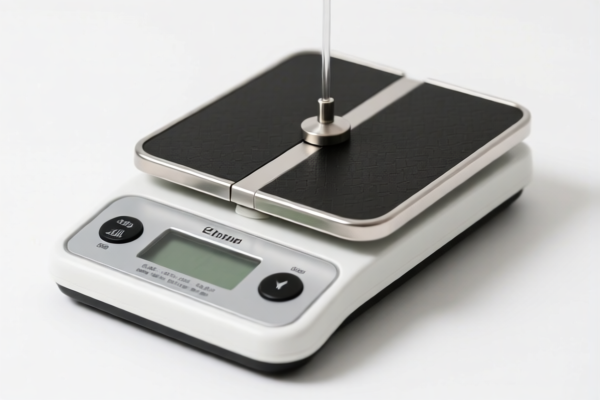

5. Kitchen Electronic Scale

HS CODE: 8423899000

- Base Tariff Rate: 2.9%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 57.9%

- Notes:

- This is a consumer-grade scale used in kitchens.

- The April 11 Special Tariff increases the rate from 25% to 30%.

- Proactive Advice: Ensure the product is not classified under a different category (e.g., food processing equipment).

📌 Key Takeaways & Recommendations

- April 11, 2025 Special Tariff: Applies to all products listed, increasing the rate from 25% to 30%.

- Base Tariff: Varies by product type (e.g., 0.0% for general scales, 2.9% for platform/kitchen scales).

- Certifications: Ensure compliance with any required certifications (e.g., CE, FCC, or safety standards).

- Material & Unit Price: Verify the exact material and unit price to avoid misclassification and incorrect tariff application.

- Customs Declaration: Accurate product description and HS code classification are critical to avoid delays or penalties.

Let me know if you need help determining the correct HS code for a specific model or brand of weighing scale.

Customer Reviews

No reviews yet.