| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8423100010 | Doc | 30.0% | CN | US | 2025-05-12 |

| 8423100060 | Doc | 30.0% | CN | US | 2025-05-12 |

| 8423100030 | Doc | 30.0% | CN | US | 2025-05-12 |

| 8423810040 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8423300000 | Doc | 55.0% | CN | US | 2025-05-12 |

Here is the classification and tariff information for weight scales based on the provided HS codes:

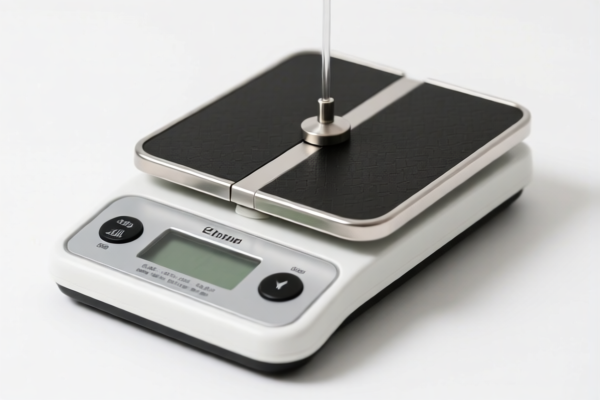

✅ HS CODE: 8423100010

Product Description: Digital electronic personal weighing machines, including baby scales and household scales

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Key Notes:

- This code applies specifically to digital electronic personal scales.

- Verify if your product is digital and used for personal purposes (e.g., baby or household use).

- Check if any certifications (e.g., CE, FCC) are required for import.

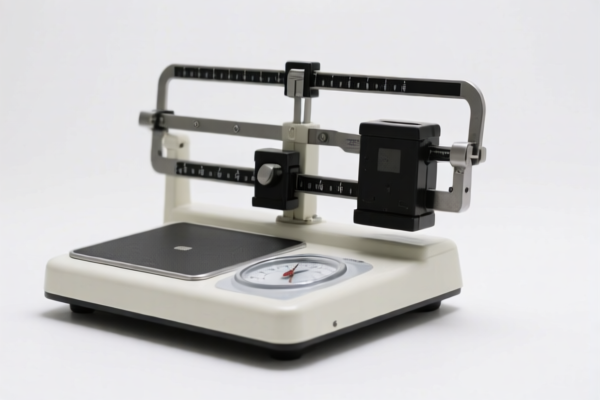

✅ HS CODE: 8423100060

Product Description: Personal weighing machines, including baby scales; household scales – other

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Key Notes:

- This code covers non-digital personal scales (e.g., mechanical or analog).

- Ensure your product does not fall under the digital category (8423100010).

- Check if your product is intended for personal use (not industrial or commercial).

✅ HS CODE: 8423100030

Product Description: Personal weighing machines, including baby scales; household scales – portable type

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Key Notes:

- This code applies to portable personal scales (e.g., handheld or travel-friendly).

- Confirm that your product is portable and used for personal purposes.

- Verify if your product is digital or analog, and ensure it is not classified under a different code.

✅ HS CODE: 8423810040

Product Description: Weighing scales for weight detection (electronic)

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: May apply (check for specific materials)

- Key Notes:

- This code is for electronic weight detection scales, possibly used in industrial or commercial settings.

- Higher tariffs apply due to additional duties.

- Check if your product is subject to anti-dumping duties based on material (e.g., iron or aluminum components).

- Verify the exact function and use case of your product.

✅ HS CODE: 8423300000

Product Description: Counting scales

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: May apply (check for specific materials)

- Key Notes:

- This code applies to counting scales, which are used to count items by weight (e.g., in manufacturing or logistics).

- Higher tariffs apply due to additional duties.

- Check if your product is subject to anti-dumping duties based on material (e.g., iron or aluminum components).

- Verify the exact function and use case of your product.

📌 Proactive Advice for Importers:

- Verify the product type (digital, analog, portable, counting, or industrial use).

- Check the material composition to determine if anti-dumping duties apply.

- Confirm the unit price and certifications required (e.g., CE, RoHS, FCC).

- Plan ahead for the April 11, 2025 tariff increase and adjust pricing or sourcing accordingly.

- Consult a customs broker if unsure about classification or duty applicability.

Let me know if you need help determining which code applies to your specific product!

Customer Reviews

No reviews yet.