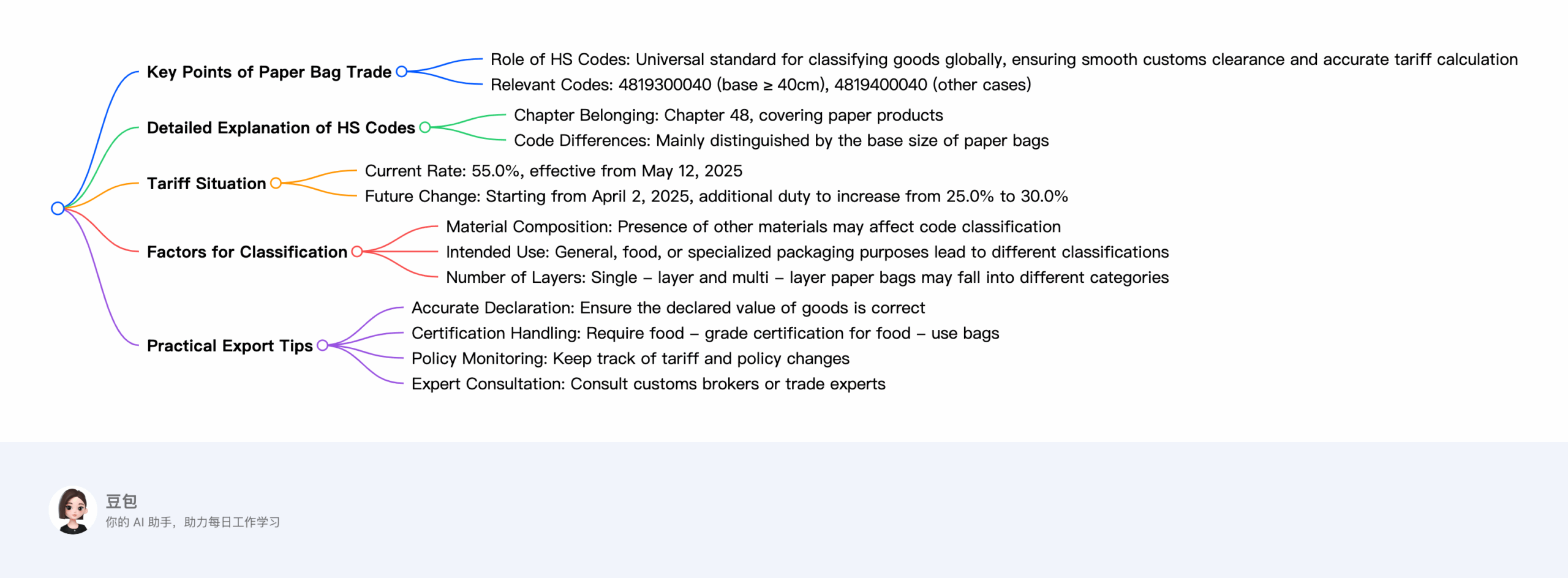

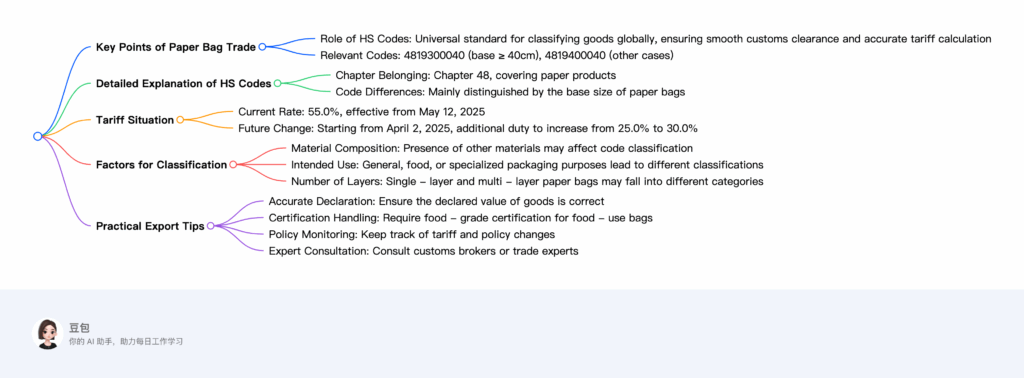

In the dynamic world of international trade, especially when it comes to exporting paper bags from China to the United States, understanding HS codes and associated trade regulations is not just beneficial—it’s essential. These codes serve as the universal language for classifying goods, ensuring smooth customs clearance and accurate tariff calculations. In this blog post, we’ll dive deep into the intricacies of HS codes for paper bags and shed light on the current trade scenario.

The Crucial Role of HS Codes

HS codes, or Harmonized System codes, are a standardized numerical method of classifying traded products. For paper bags, two specific HS codes come into play: 4819300040 and 4819400040. Both of these codes fall under Chapter 48 of the HS system, which encompasses products made from paper, paperboard, pulp, etc. The classification under this chapter is based on the nature and characteristics of the paper bag.

Decoding the HS Codes

The code 4819300040 is designated for sacks and bags with a base of 40 centimeters or more. On the other hand, 4819400040 applies to other sacks and bags, including cones. The key differentiator between these two codes lies in the base size of the paper bag. This seemingly simple factor can have a significant impact on customs duties and trade compliance.

Tariff Landscape

Currently, the tariff rate for both of these HS codes stands at 55.0%, effective as of May 12, 2025. However, it’s crucial to note that there is a looming change on the horizon. Starting from April 2, 2025, the additional duty will increase from 25.0% to 30.0%. These fluctuations in tariff rates can directly affect the cost of goods and profit margins for exporters and importers alike.

Key Considerations for Correct Classification

While the base size is a primary determinant in choosing the right HS code, several other factors come into play:

- Material Composition: Is the paper bag made of 100% paper? Or does it have plastic linings or coatings? Any additional materials can potentially change the HS code classification.

- Intended Use: Whether the bag is used for general packaging, food packaging, or specialized purposes can influence its classification. For instance, food packaging bags may have specific regulatory requirements.

- Number of Layers: Single – layer or multi – layer paper bags might fall into different categories.

Practical Tips for Exporters

- Accurate Declaration: Ensure that the declared value of the paper bags is accurate. Customs authorities rely on this information to calculate duties, and any discrepancies can lead to delays or penalties.

- Certifications: If the paper bags are intended for food use, they may require food – grade paper certifications. Staying compliant with such requirements is vital.

- Stay Informed: Keep a close eye on regulatory changes, especially the upcoming increase in additional duties. Incorporate these changes into your cost calculations to maintain profitability.

- Seek Expert Advice: Given the complexity of HS code classification and trade regulations, it’s advisable to consult with local customs brokers or trade experts. They can provide valuable insights and ensure that your paper bag exports adhere to all requirements.

In conclusion, navigating the world of paper bag exports with the correct HS code and a clear understanding of trade regulations is the key to success in the international market. By paying attention to the details and staying informed, exporters can avoid costly mistakes and ensure a seamless trading experience. If you have any specific questions regarding the base size, material composition, or intended use of your paper bags, feel free to reach out, and we’ll be happy to assist you in determining the appropriate HS code.